Windhoek Mines, Limited, Of Namibia, Is Contemplating The Purchase Of

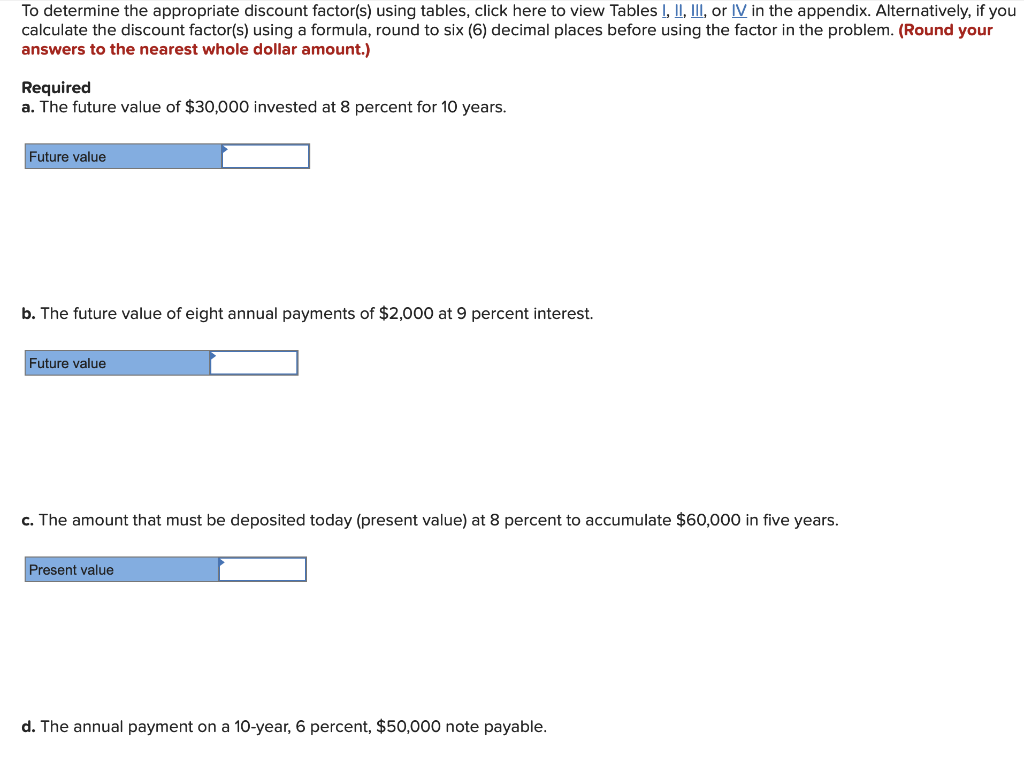

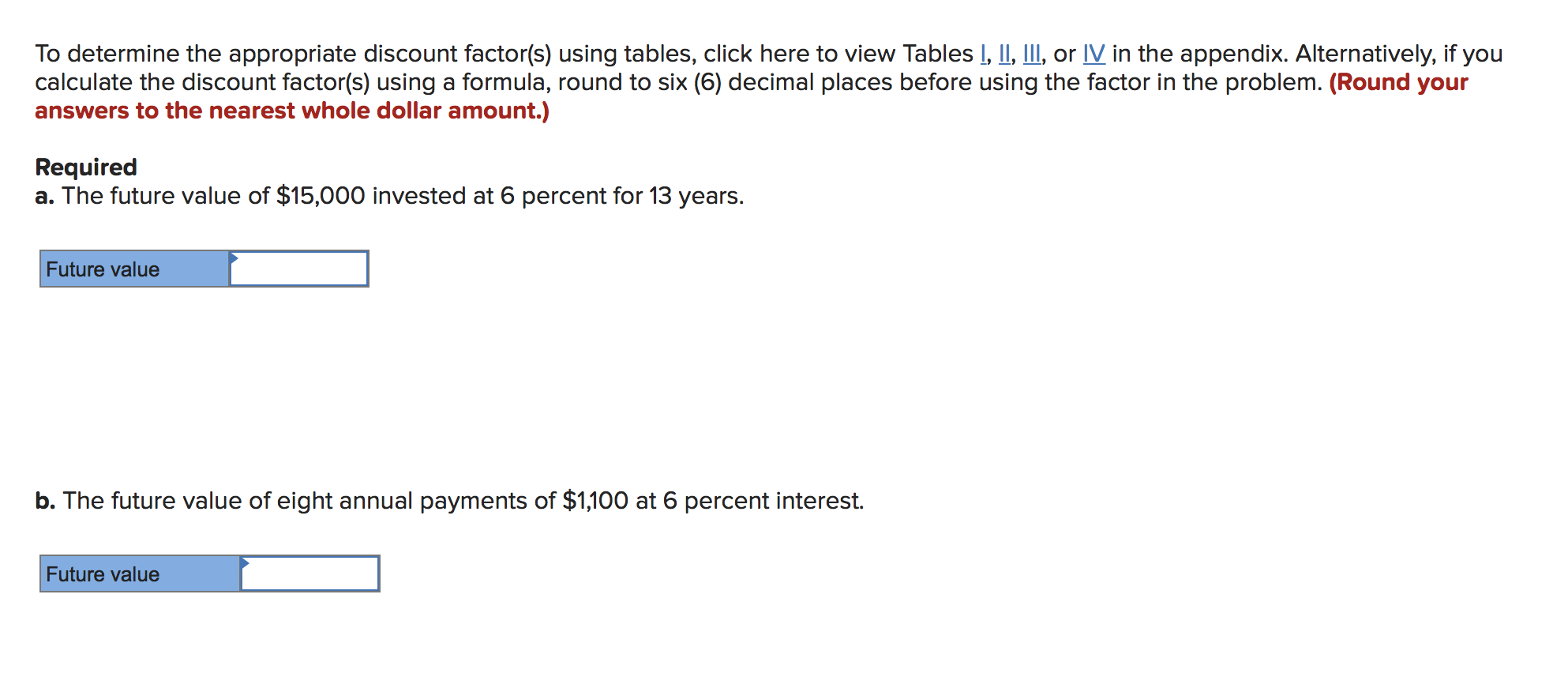

This text is providing guidance on how to determine the appropriate discount factor using various tables and formulas. The discount factor is crucial in estimating the present value of future cash inflows at a given interest rate. Instructions on how to calculate the discount factor using a formula, calculator, and an Excel template are also provided. Additionally, an example is given for calculating the discount factor for a 7% discount rate.

To calculate the net present value (NPV) of the proposed mining project for Windhoek Mines, Limited, we need to discount the cash inflows and outflows to their present values using the appropriate discount factor.

First, let's calculate the present value of the cash flows:

PV of Initial Investment (Year 0) = $480,000 (Cost of new equipment and timbers) + $170,000 (Working capital required) PV of Annual Cash Receipts: Year 1: $185,000 (PVIF 18%, 1) Year 2: $185,000 (PVIF 18%, 2) Year 3: $185,000 (PVIF 18%, 3) Year 4: $185,000 (PVIF 18%, 4)

PV of Cost to Construct New Roads in Three Years: $54,000 (PVIF 18%, 3) PV of Salvage Value of Equipment in Four Years: $79,000 (PVIF 18%, 4)

Now, let's sum up the present values of all the cash flows:

NPV = PV of Initial Investment + PV of Annual Cash Receipts - PV of Cost to Construct New Roads - PV of Salvage Value of Equipment

NPV = $480,000 + $170,000 + $130,122 - $27,755 - $38,726 NPV = $713,641

Therefore, the net present value of the proposed mining project is $713,641. Since the NPV is positive, the project should be accepted as it is expected to generate positive value and yield returns higher than the required rate of return of 18%.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.