What Is Ohio Sales Tax Rate?

As of 2025, Ohio has a base state sales tax rate of 5.75%. Additionally, local jurisdictions can impose their own sales taxes, resulting in an average combined rate that can range from 5.75% to 8%, depending on the specific location within the state.

Notably, certain counties like Franklin County and Union County will see an increase in their local sales tax rates from 7.5% to 8%, effective April 1, 2025, which will contribute to the overall sales tax rate in those areas. For specific calculations or to find your exact sales tax rate, you can utilize sales tax calculators available online, such as the one provided by Avalara.

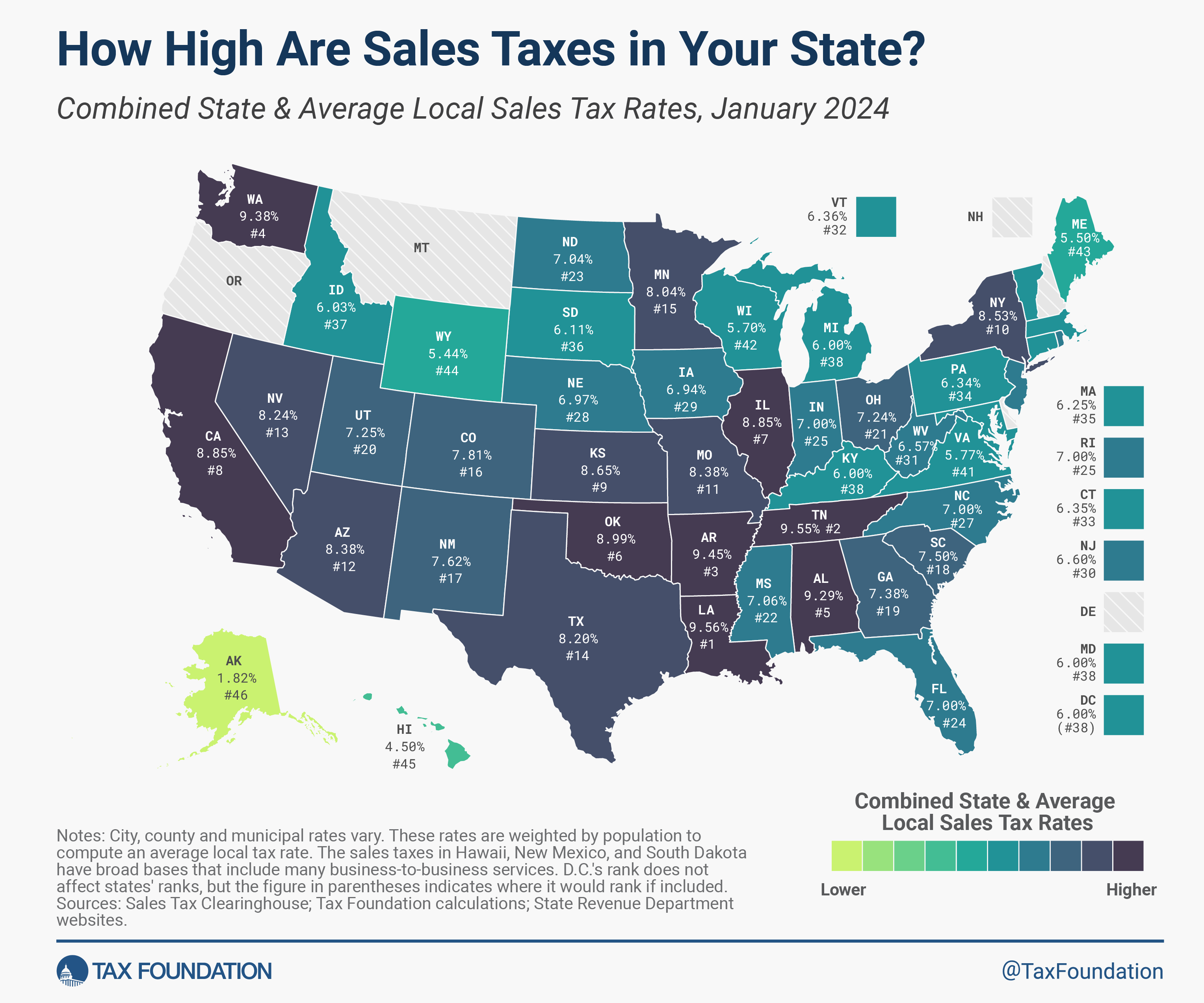

For further details regarding sales tax rates and any forthcoming changes, visitors are encouraged to explore links from the Ohio Department of Taxation, which include specific pages for sales tax guidelines, rate changes, and other tax-related information (Ohio Department of Taxation - Sales & Use Tax, Tax Rates & Changes) and resources from the Tax Foundation (Ohio Tax Rates & Rankings).

These resources can provide valuable insights into the sales tax structure in Ohio and any local variations that may affect purchases in different municipalities.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.