What forms do I need to file for an income

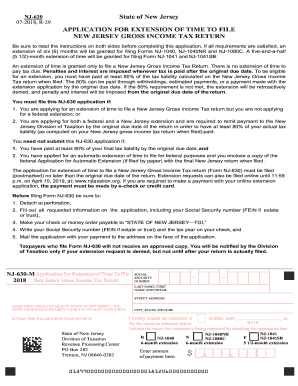

To file for an income tax extension in New Jersey, you will need to complete Form NJ-630, which is the Application for Extension of Time to File New Jersey Gross Income Tax Return. This form allows you to request a 6-month extension for filing your personal income tax returns. It is essential to submit Form NJ-630 by the original due date of your tax return.

Here are some important details regarding the process:

-

Form NJ-630: This form serves both as a request for an extension and as a voucher for any payment due. If you owe taxes, you must include the payment with your extension request to avoid penalties. More information can be found in the detailed guide on how to prepare Form NJ-630 available at Thomson Reuters.

-

Extension Duration: When filed, this extension grants you an additional 6 months to submit your tax return, but be aware that it does not extend the time to pay any taxes owed. Late payments can incur penalties and interest.

-

Relation to Federal Extensions: If you file for a federal extension (using Form 4868), you do not need to file separately for a state extension in New Jersey. However, if you do not file a federal extension, you must complete Form NJ-630 to avoid penalties. This information is outlined on Corvee.

-

Additional Resources: For a comprehensive overview, you may refer directly to the New Jersey Division of Taxation document on Form NJ-630, which can be accessed here, and the FAQs provided by FreeTaxUSA.

By following these guidelines and ensuring the timely submission of Form NJ-630, you can secure your extension for filing your New Jersey income tax returns.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.