What Are Some Internal Controls For Contracting

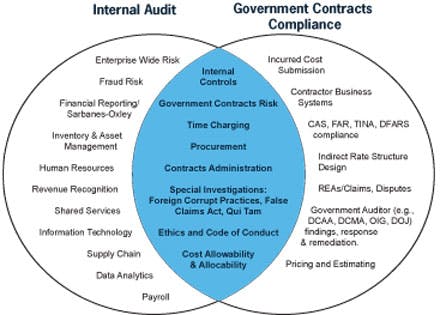

Contract costs should be protected by guardrails, and having adequate documentation to support estimated costs is crucial. Implementing internal controls such as customer billing and proper contract performance can prevent and detect fraud. It is important for contractors to establish and review internal controls, especially during growth periods, to ensure compliance with contractual requirements. A strong internal control policy should cover finance, operations, and administration, and professional assistance is available for developing policies and processes to demonstrate compliance.

Internal controls for contracting are crucial for ensuring transparency, compliance, and risk management. Some key internal controls for contracting include:

-

Segregation of Duties: Separation of duties between personnel involved in the contracting process can help prevent fraud and errors. For example, the personnel responsible for creating contracts should not be the same individuals who approve payments.

-

Contract Review and Approval: Implement a standardized process for reviewing and approving contracts to ensure compliance with internal policies and applicable laws and regulations.

-

Documentation and Record-Keeping: Maintain detailed documentation for all contracting activities, including agreements, approvals, amendments, and correspondence, to provide an audit trail and support transparency.

-

Vendor Due Diligence: Perform thorough due diligence on potential vendors, including background checks, financial reviews, and reputation assessments, to mitigate the risk of engaging with unreliable or fraudulent entities.

-

Monitoring and Reporting: Establish monitoring mechanisms to track the performance of contracts, expenditures, and compliance with contract terms. Regular reporting on contract status and financial implications can help identify issues early on.

-

Compliance with Regulations: Ensure that all contracting activities comply with relevant laws, regulations, and company policies, such as anti-corruption laws, conflict of interest policies, and procurement regulations.

-

Financial Controls: Implement financial controls to manage contract costs, billing, and payment processes effectively. This may include budgetary controls, expense approvals, and verification of invoiced amounts.

These internal controls help mitigate risks, promote accountability, and safeguard the integrity of contracting processes within an organization.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.