Using a financial calculator or a spreadsheet, calculate the yield

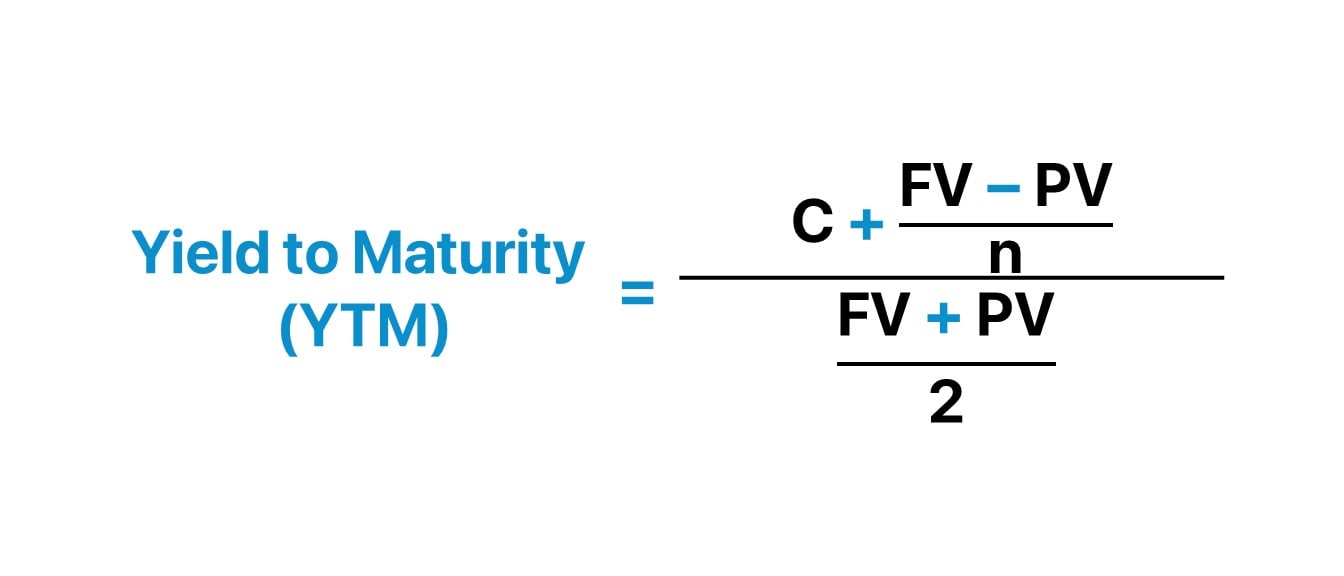

To calculate the yield to maturity (YTM) for the given bond, we can use the formula for YTM, which considers the present value of future cash flows from the bond (coupon payments and the par value at maturity) against its current price.

Here's a step-by-step breakdown:

-

Given Data:

- Face value (FV): $10,000

- Annual coupon rate: 3.5%, implying a semi-annual coupon of $175 ($10,000 * 3.5% / 2)

- Number of periods (N): 4 years remaining means 8 semi-annual periods.

- Current price (P): $9,929

-

Cash Flows:

- The bond will pay $175 every six months for the next 8 periods, followed by the $10,000 face value at the end of the 8th period.

-

YTM Calculation: Using a financial calculator or spreadsheet, input the following:

- PV = -9,929 (current price, entered as a negative because it’s an outflow)

- PMT = 175 (coupon payment)

- FV = 10,000 (face value)

- N = 8 (total periods)

-

Finding YTM: By solving for the interest rate (YTM) that equates the present value of cash flows to the current price, you find:

After performing the computation, the yield to maturity (YTM) rounds to 3.68%.

So the answer is 3.68.

Sources

How To Calculate Yield To Maturity (With Example and Formula)Yield to Maturity Calculator | Calculate YTMYield to Maturity (YTM): What It Is and How It Works - InvestopediaBond Yield Calculator - CalculateStuff.comBond CalculatorHow to Calculate Semi-Annual Bond Yield | The Motley FoolIntroduction to Fixed Income Valuation | IFT World

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.