tlumavz We ended last Friday with the H1 - H4

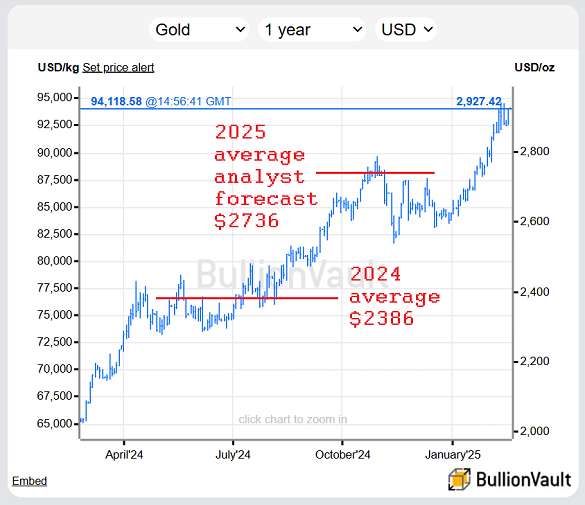

According to the latest analysis provided, the gold market is showing significant upward momentum, closing above the pivotal level of 3006 as of last Friday. This indicates a robust bullish trend in the short term. The recommended trading strategy for early next week involves looking for a price retracement to the 3017 - 3008 zone, where buying gold is prioritized. The targets for this trading approach include price levels at 3029, 3041, and 3052.

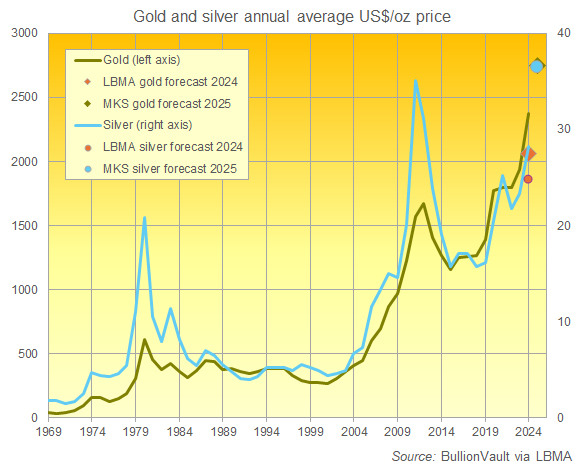

Recent market reports support this analysis, with gold prices recently surging to record highs. For instance, a report from Reuters noted that gold hit a peak of $3,057.21 per ounce, attributing the rise to safe-haven demand amidst market uncertainties and expectations of rate easing by the US Federal Reserve. This was echoed in various analyses, including coverage from Kitco, which hinted at a possible imminent price correction, aligning with the need for traders to watch for retracement opportunities before entering new positions.

Links to recent relevant articles include:

- KITCO Commentary on Gold Market Analysis - Discusses various market dynamics influencing gold prices.

- Reuters Report on Gold Price Surge - Details recent record high prices and market expectations.

- YouTube Price Prediction for Gold - Provides technical analysis and predictions for upcoming price movements.

- Elliott Wave Analysis and Forecast for Gold - Offers technical insights and long position targets.

- Forbes Article on Gold Price Rally - Explains the factors contributing to gold's rise above $3,000 per ounce.

- FXEmpire Price Forecast for Gold - Analyzes current price conditions and potential corrections.

Overall, the market sentiment suggests that while gold is currently robust, there may be short-term pullbacks that traders should leverage for potential buying opportunities.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.