Sorry, I Mean Crypto Short Seller

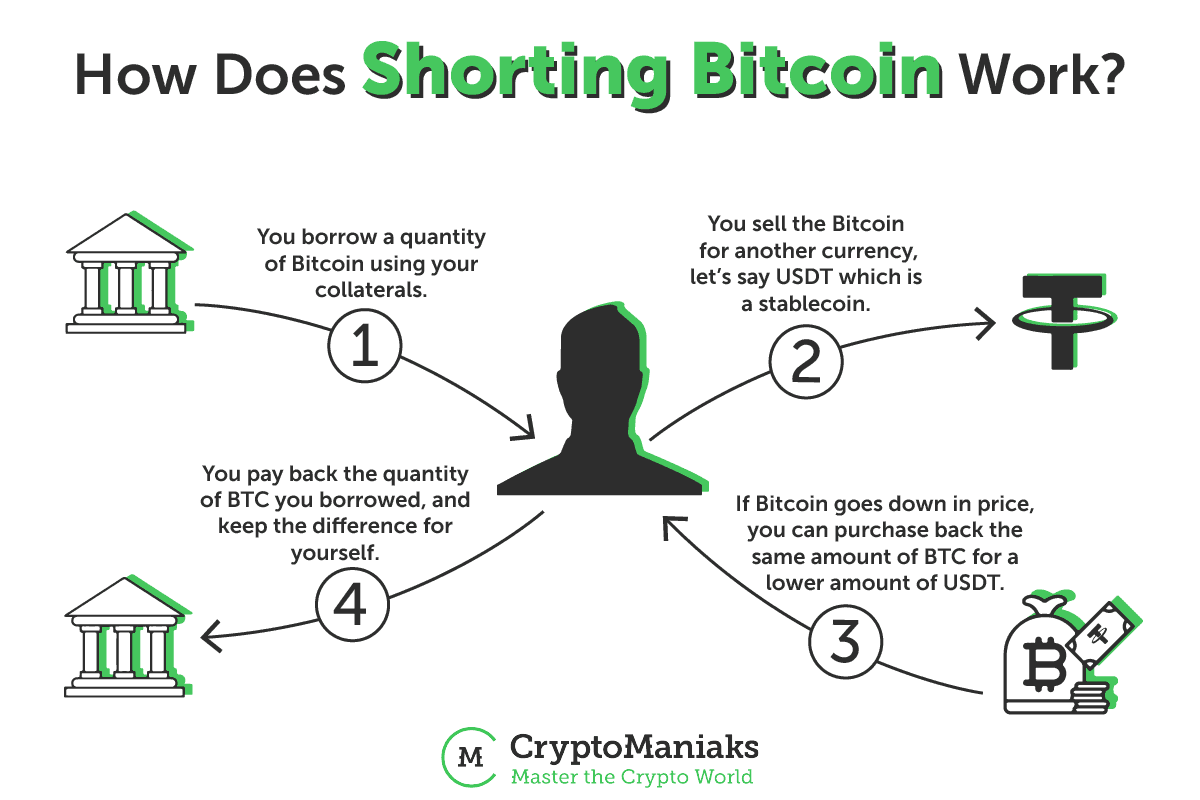

The text discusses the practice of shorting cryptocurrencies, which involves selling cryptocurrencies in anticipation of price declines in order to make a profit. Covo Finance is highlighted as a user-friendly platform for shorting, with high leverage options. Short sellers cover their positions by buying back the assets at a lower price. The text mentions the current rise of Bitcoin and the common methods for shorting it, such as using derivatives like futures and options. However, shorting cryptocurrency can be a risky strategy due to the volatility of the market. Recent market conditions have resulted in losses for short sellers. The text also provides a general guide and steps to shorting cryptocurrencies.

A crypto short seller is someone who engages in the practice of short selling cryptocurrencies. This involves selling cryptocurrencies with the expectation that their prices will decrease, allowing the seller to buy them back at a lower price to make a profit. Short selling in the crypto market often involves using derivatives such as futures or options. However, it's important to note that short selling cryptocurrencies can be a high-risk strategy due to the volatile nature of the market. It's essential for individuals considering this approach to fully understand the risks involved and to proceed with caution.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.