Someone In Australia With A Salary Of $110,000, What Would aicndbU

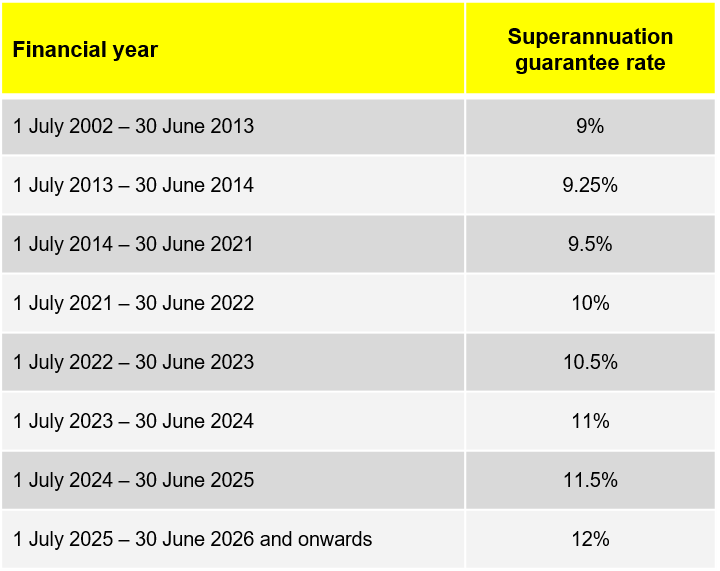

In Australia, the mandatory Superannuation Guarantee (SG) contribution rate for the 2024 financial year is 11.5% of your ordinary time earnings (OTE).

For someone earning a salary of $110,000, the minimum Superannuation contribution would be calculated as follows:

- Salary: $110,000

- Superannuation Contribution Rate: 11.5%

Calculation: [ \text{Superannuation} = \text{Salary} \times \text{Superannuation Rate} ] [ \text{Superannuation} = 110,000 \times 0.115 = 12,650 ]

Therefore, the minimum Superannuation contribution on top of the salary of $110,000 would be $12,650.

For more detailed information, you can refer to the Australian Taxation Office here or check comprehensive updates on Superannuation rates on Nationwide Super.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.