show me The process of eliminating intercompany sales involves debiting

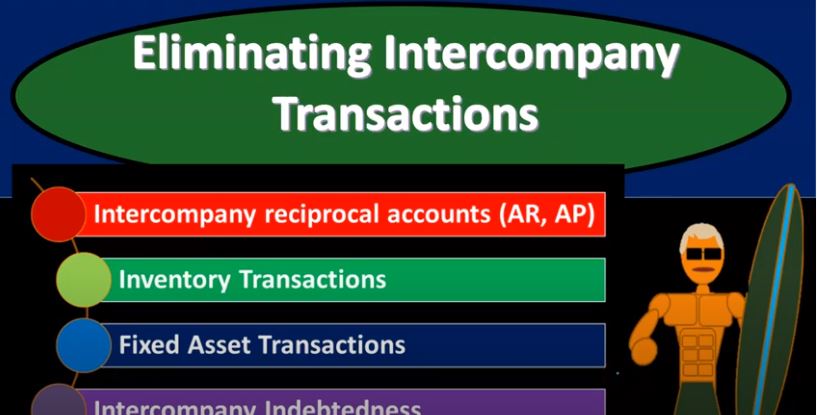

The process of eliminating intercompany sales is an important aspect of preparing consolidated financial statements. When companies within the same corporate group engage in transactions, such as sales of inventory to each other, these transactions must be eliminated to avoid inflating revenues and profits in the consolidated financial statements.

Here is a concise rundown of the process:

-

Debiting Sales: The intercompany sales account is debited. This action removes the recorded sales revenue from the consolidated financial statements to reflect that these sales do not represent actual outflows of resources to external parties.

-

Crediting Inventory: The profit made on the inventory sold intercompany needs to be eliminated from inventory on the balance sheet. Thus, you credit the inventory account to adjust for the profit that is still embedded in the inventory held by the purchasing company.

-

Crediting COGS (Cost of Goods Sold): The remaining balance is credited to the Cost of Goods Sold. This entry accounts for the elimination of the profit associated with the intercompany transaction that has not yet been realized by the group as a whole until the inventory is sold to external customers.

In summary, the entries made during the elimination of intercompany sales involve debiting sales, crediting inventory for the profit, and crediting COGS for the remaining balance, which is the correct accounting treatment as firms prepare to consolidate their financial statements.

For more detailed guidance and examples on intercompany eliminations, you can refer to resources such as the PwC Viewpoint and SoftLedger.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.