Provide A Monthy Budget Considering Each Transaction

A budget is a financial management tool used to track income and expenses over a specific time period. It is used by individuals, businesses, and governments to plan and track financial resources. To create a budget, one must identify their income and categorize expenses into necessary and discretionary. Using the 50/30/20 rule, one can allocate income towards needs, wants, and savings. It is recommended to list all expenses and use budgeting tools to track spending. Variable expenses, such as groceries and utilities, should also be accounted for in a budget.

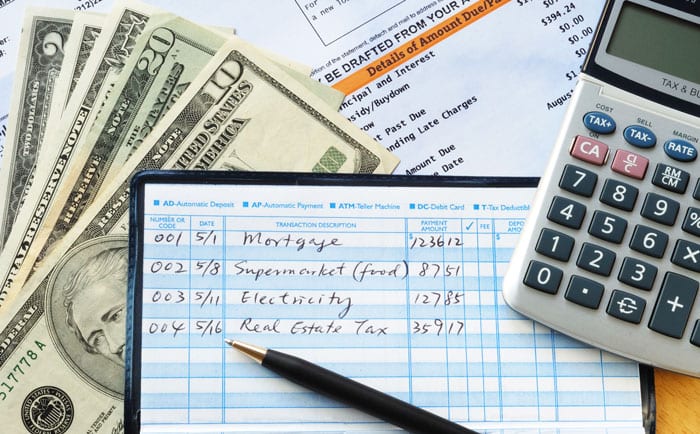

To create a monthly budget considering each transaction from the provided bank statement, we can follow these steps:

-

Identify Income: List all sources of income, including wages, investments, and any other inflows for the month.

-

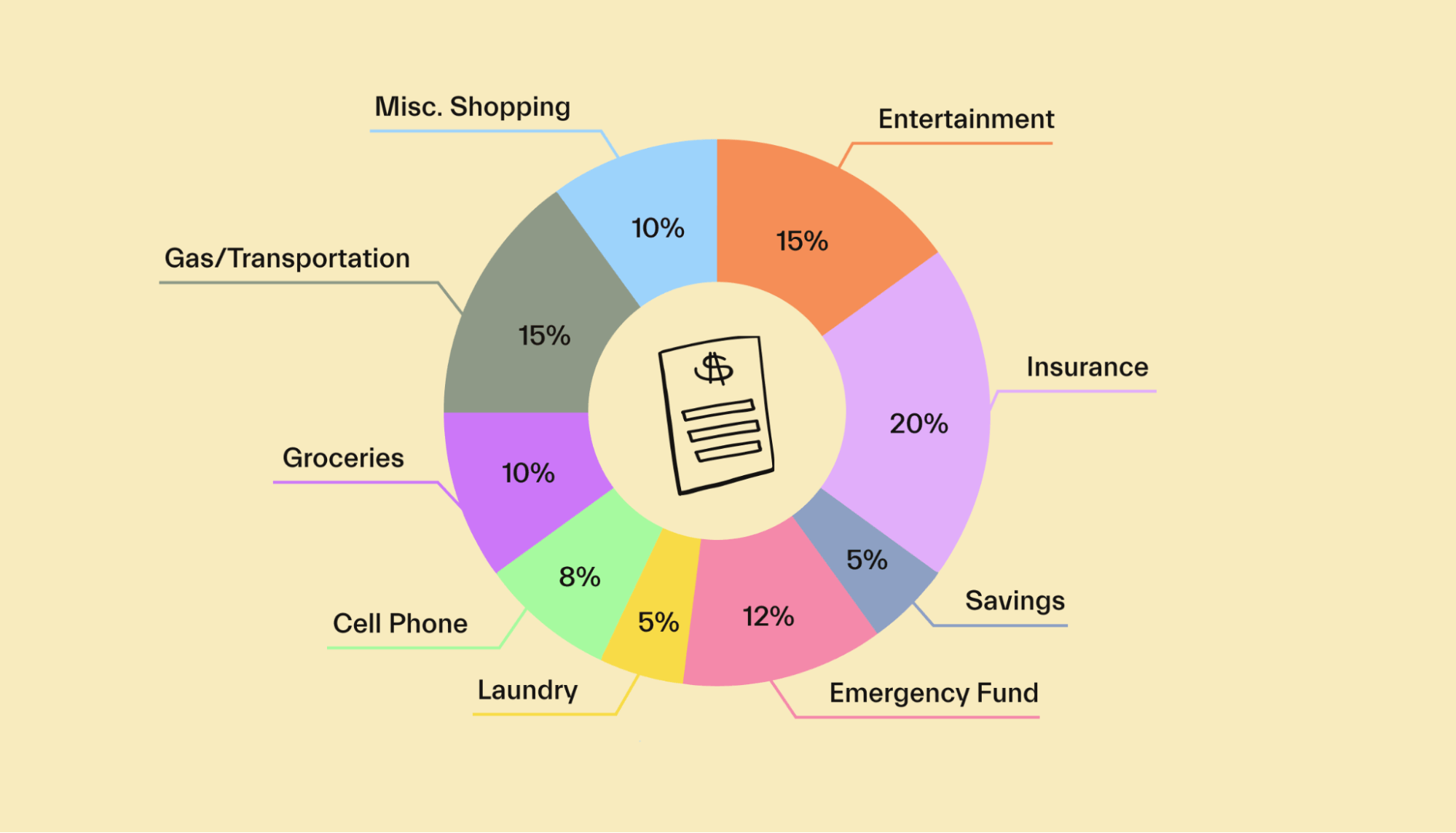

Categorize Expenses: Based on the transactions from the bank statement, categorize each expenditure into specific spending categories such as groceries, utilities, entertainment, dining, insurance, debt payments, and any other relevant categories.

-

Allocate Funds: Utilize a budgeting method, such as the 50/30/20 rule, to allocate income towards needs (50% of income), wants (30% of income), and savings (20% of income). Adjust the percentages according to personal circumstances.

-

List Variable Expenses: Recognize variable expenses and account for them in the budget. These might include groceries, fuel, or any other expenses that may change from month to month.

-

Review and Adjust: Regularly review the budget and make adjustments as necessary. It's essential to monitor spending and income regularly and make changes as needed to stay on track.

-

Consider Future Expenses: Also, consider future or irregular expenses, such as insurance premiums, vehicle maintenance, or other annual or semi-annual costs. Allocate a portion of monthly income towards these expenses to ensure they can be covered when they arise.

By incorporating each transaction from the bank statement into these steps, it will be possible to create a comprehensive monthly budget that reflects actual spending and income patterns.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.