Northern Products Inc. Pays Its Employees Every Friday For The

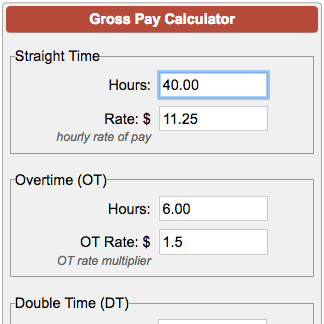

The gross income or pay of a company or individual is determined by subtracting costs or deductions from the total revenue or salary. This can be calculated by entering a desired take-home pay, dividing yearly pay by the number of pay periods, or multiplying hourly wage by the number of hours worked. Gross pay does not include taxes or deductions and can be calculated online or manually for different pay frequencies.

To calculate the values requested, we will use the information provided and the given tax rates.

Let's start with the calculations for each employee and then sum up the totals.

For Bob:

- Hourly Wage: $23

- Hours: 39

- Gross Earnings: $897

- Federal Income Tax: $116.61

- State Income Tax: $71.76

- FICA Tax: $68.77

- Union Dues: $12

- Health Insurance: $33

- Total Deductions: $301.14

- Net Pay: $595.86

For Nishi:

- Hourly Wage: $15

- Hours: 39

- Gross Earnings: $585

- Federal Income Tax: $76.05

- State Income Tax: $46.80

- FICA Tax: $44.78

- Union Dues: $12

- Health Insurance: $33

- Total Deductions: $212.83

- Net Pay: $372.17

For Max:

- Hourly Wage: $22

- Hours: 32

- Gross Earnings: $704

- Federal Income Tax: $91.52

- State Income Tax: $56.32

- FICA Tax: $53.93

- Union Dues: $12

- Health Insurance: $33

- Total Deductions: $246.77

- Net Pay: $457.23

For Randy:

- Hourly Wage: $23

- Hours: 36

- Gross Earnings: $828

- Federal Income Tax: $107.64

- State Income Tax: $66.24

- FICA Tax: $63.49

- Union Dues: $12

- Health Insurance: $33

- Total Deductions: $282.37

- Net Pay: $545.63

For Ursula:

- Hourly Wage: $24

- Hours: 33

- Gross Earnings: $792

- Federal Income Tax: $103.23

- State Income Tax: $63.36

- FICA Tax: $60.56

- Union Dues: $12

- Health Insurance: $33

- Total Deductions: $272.15

- Net Pay: $519.85

For the Total:

- Gross Earnings: $3806

- Federal Income Tax: $494.05

- State Income Tax: $304.48

- FICA Tax: $291.53

- Union Dues: $60

- Health Insurance: $165

- Total Deductions: $1314.06

- Net Pay: $2491.94

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.