interest bearing note vs nointerest bearing note

Interest-bearing notes and non-interest-bearing notes are two distinct financial instruments utilized in lending and borrowing scenarios.

Interest-Bearing Notes

An interest-bearing note is a debt instrument that guarantees the payment of interest in addition to the principal amount loaned. The interest is accrued based on the terms specified in the note, including the rate and schedule for payment. These notes are structured to provide a specific nominal interest rate, with payments made on a regular basis, which can be monthly, quarterly, or annually. For instance, the details regarding the interest-bearing nature of these notes can be found on resources like AccountingTools and SuperfastCPA.

The main features of interest-bearing notes include:

- Stated interest rate: The note specifies the rate of interest and the timeframe for payments.

- Accrual of interest: The interest accumulates in accordance with the terms agreed upon by the borrower and lender. This is highlighted in educational material found in Intermediate Financial Accounting 2.

Non-Interest-Bearing Notes

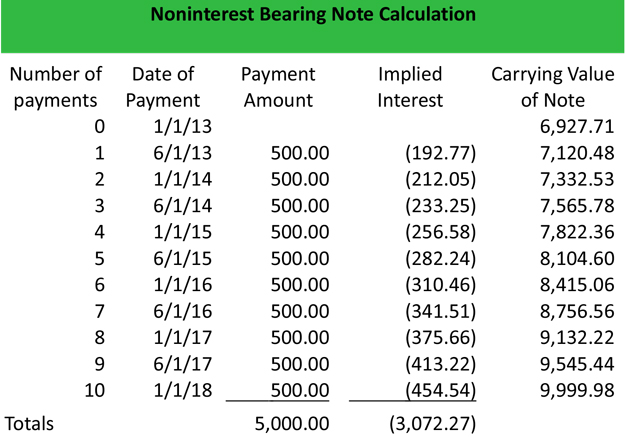

In contrast, a non-interest-bearing note does not provide any interest payments. These notes are essentially a promise to pay back the principal amount at a later date, with no additional interest accrued over time. Non-interest-bearing notes are generally issued at a discount to their face value, and the profit for the lender comes from the difference between the amount financed and the eventual maturity value.

The key distinction lies in the financial benefits offered to the lender via interest in the first case, compared to a pure repayment of the principal in the second. More information about non-interest-bearing notes can be inferred from discussions of financial instruments like those appearing in Saylor Academy.

Conclusion

Understanding the differences between these two types of notes is essential for making informed financial decisions. Interest-bearing notes are beneficial for lenders seeking returns on their investments through interest payments, while non-interest-bearing notes might be more appealing in scenarios where the cost of interest is not desired by the borrower. For further insights into interest-bearing notes, resources like Accounting Insights and World Bank can provide detailed guidance on their features and implications in financial operations.Interest-bearing notes and non-interest-bearing notes are two distinct types of debt instruments that differ primarily in their payment structure and how they generate returns for lenders.

Interest-Bearing Notes

An interest-bearing note is a financial instrument through which funds are lent from a lender to a borrower, with the agreement that interest will be paid on top of the principal amount. This type of note specifies a stated interest rate that governs the payments made at regular intervals, such as monthly or quarterly. Interest accrued represents the additional compensation for the lender assuming the risk of the loan and is explicitly outlined in the terms of the note. For detailed information on interest-bearing notes, you can refer to sources like AccountingTools and SuperfastCPA.

Non-Interest Bearing Notes

In contrast, a non-interest-bearing note does not require the borrower to make interest payments to the lender. These notes have no documented interest rate, meaning they do not accrue traditional interest over their term. However, it is important to consider the time value of money when dealing with non-interest-bearing notes, as the cash flow implications differ significantly. For example, the borrower might receive a lump sum that is less than the face value of the note upon maturity, which compensates for the lack of interest payments. For more details, see AccountingTools and Superfast CPA.

Key Differences

The primary distinction lies in the payment structure:

- Interest-Bearing Notes: Involve periodic interest payments, providing a direct return to the lender.

- Non-Interest Bearing Notes: Lack periodic interest payments, often resulting in a lower initial cash amount lent but are settled at maturity for the full face value.

Understanding these differences can aid in choosing the appropriate financial instrument based on the desired return profile and cash flow requirements.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.