In victoria BC how much money would I need to

To determine the gross income required to bring home $22,000 per month in Victoria, BC, you can utilize various online income tax calculators designed for Canadian salaries. Here are some useful resources:

-

CareerBeacon Income Tax Calculator: This tool helps you calculate your after-tax salary based on federal and provincial tax brackets and rates. You can find it here.

-

Relocate.me Net Salary Calculator: Another effective tool that allows you to estimate your take-home pay by calculating the expected taxes on your salary can be accessed here.

-

Talent.com Income Tax Calculator: This calculator is beneficial for estimating payroll tax deductions within British Columbia for the 2025 tax year. Check it out here.

-

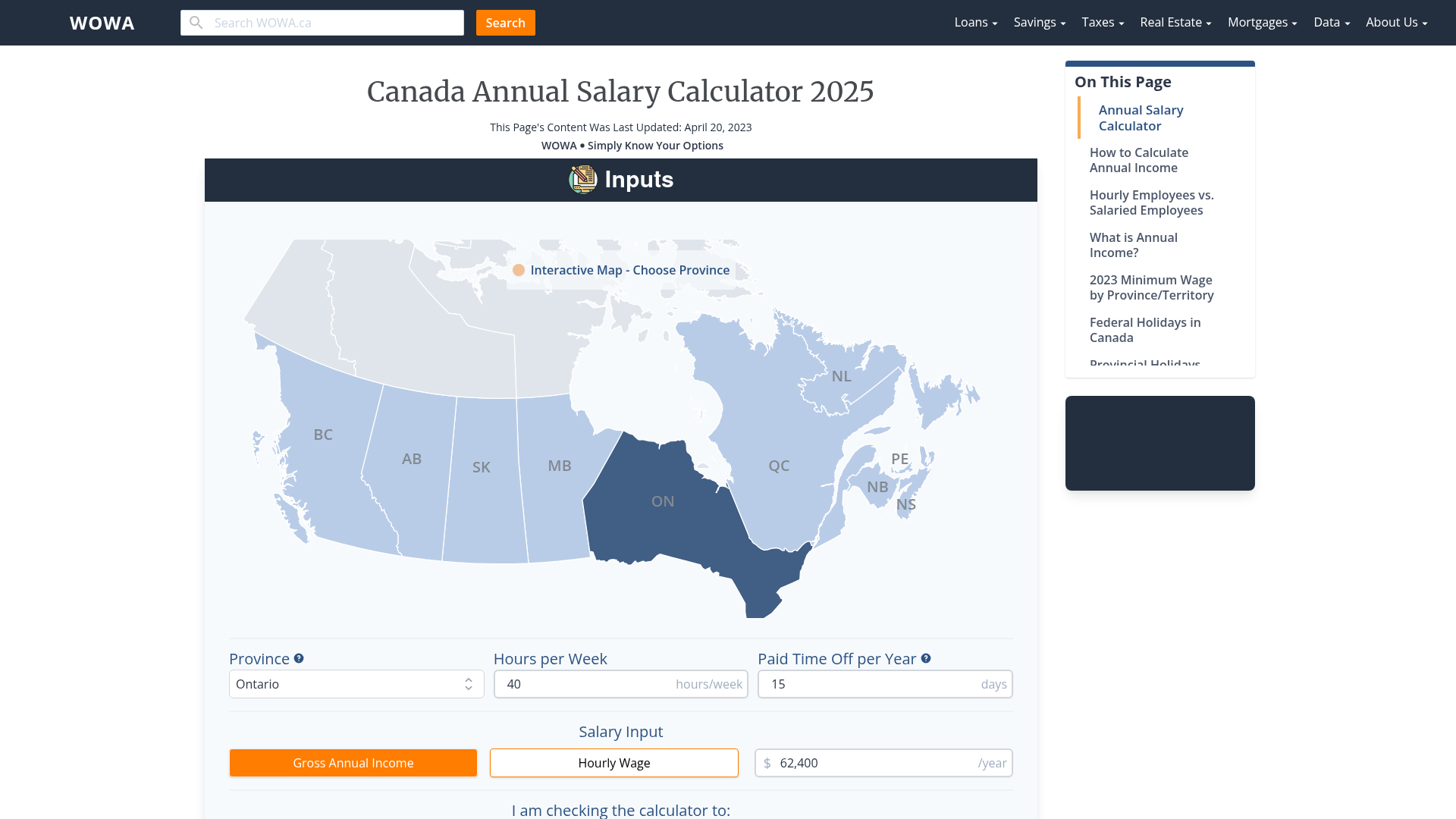

WOWA Annual Salary Calculator: Useful for finding your annual after-tax income based on your hourly wage and total working hours, this calculator is available here.

-

TurboTax BC Income Tax Calculator: This resource allows you to estimate your provincial taxes and check your marginal tax rate. Find it here.

To specifically calculate how much you would need to earn in order to net $22,000 per month (or $264,000 annually), these tools will guide you in accounting for both federal and provincial taxes applicable in British Columbia, ensuring that you understand the entire tax implication of your desired take-home pay.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.