in the above include what a interest bearing note and

Interest Bearing Note vs. Non-Interest Bearing Note: Definitions, Stated Rate, and Effective Rate

Definitions

An interest-bearing note is a type of debt instrument whereby funds are loaned from a lender to a borrower with the explicit promise to pay interest in addition to the principal amount at specified intervals. The terms of the note typically outline the interest rate, payment schedule, and the principal amount involved. More information can be found at AccountingTools and SuperfastCPA.

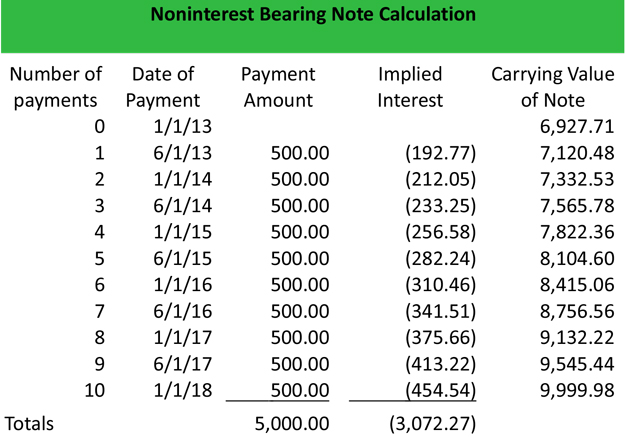

Conversely, a non-interest-bearing note is a financial instrument that does not stipulate any interest payments over its term. Instead of periodic interest payments, the borrower repays the principal amount, often at a face value higher than the initial amount lent. This type of note is usually issued at a discount to its face value, meaning that while the borrower may receive less upfront, they agree to pay back the face value at maturity. Further details can be explored on AccountingTools.

Interest-Bearing Notes

-

Stated Rate: The stated rate (or nominal rate) is defined within the terms of the note. It dictates how much interest will be paid on top of the principal amount. For instance, on a $1,000 note with a 5% stated interest rate, the borrower will owe $50 in interest at maturity.

-

Effective Rate: The effective interest rate is often aligned with the stated rate when the note is issued at par value. However, if the note is issued at a discount or premium, the effective interest rate could differ, giving a more accurate picture of the borrowing cost due to factors such as compounding.

Non-Interest Bearing Notes

-

Stated Rate: These notes typically have a stated rate of 0%, reflecting that there are no interest payments made over their lifespan.

-

Effective Rate: Despite the lack of a stated interest rate, a non-interest-bearing note has an effective rate calculated from the difference between the amount received at issuance and the promised maturity value. For example, if a borrower receives $900 for a note due at $1,000, then the effective interest rate is derived from this difference, representing the implicit cost of borrowing.

Conclusion

In summary, interest-bearing notes are characterized by their explicit stated rates and periodic interest payments, while non-interest-bearing notes do not involve interest payments and instead operate on an implicit interest basis. Understanding these nuances is essential for both borrowers and lenders when making financial decisions. For further reading, resources such as OpenStax, Chegg, and PwC Viewpoint offer deeper insights into these financial instruments.

Interest-Bearing Notes vs. Non-Interest-Bearing Notes: Definitions and Rate Differences

Definitions

Interest-Bearing Note: An interest-bearing note is a financial instrument that represents a loan from a lender to a borrower, with an explicit agreement that interest will be paid in addition to the principal amount. This note outlines a stated interest rate, under which the borrower will make periodic interest payments based on the loan's terms. Typically, these payments can be scheduled monthly, quarterly, semi-annually, or annually. More information can be found in articles from SuperfastCPA and AccountingTools.

Non-Interest-Bearing Note: A non-interest-bearing note, in contrast, is a debt instrument for which there is no documented requirement for the borrower to pay any interest. While it has a stated interest rate of 0%, it is typically issued at a discount to its face value, meaning the borrower pays back more than the amount initially lent at maturity. This type of note still reflects the time value of money and implies interest through the repayment structure. The concept is further explained in resources such as AccountingTools and Superfast CPA.

Stated Rate and Effective Rate

Both types of notes differ significantly regarding their stated and effective interest rates.

Interest-Bearing Notes

-

Stated Rate: The stated interest rate is specified in the note document. For example, if a note has a face value of $1,000 and the stated interest rate is 5%, the borrower is obligated to pay $50 in interest at the end of the term.

-

Effective Rate: The effective rate may differ from the stated rate, especially if the note includes more frequent compounding. The effective interest rate provides a true annualized cost of borrowing, taking into account the timing of payments and compounding.

Non-Interest-Bearing Notes

-

Stated Rate: Non-interest-bearing notes have a stated interest rate of 0% since there are no periodic interest payments made. Instead, the repayment is structured to cover only the principal amount plus any implicit interest.

-

Effective Rate: The effective interest rate for non-interest-bearing notes reflects the implicit interest charge based on the difference between the discounted cash received at inception and the face value paid at maturity. For instance, if a borrower receives $900 for a non-interest-bearing note with a face value of $1,000 due in a year, the effective rate can be calculated as (1000 - 900) / 900 = approximately 11.11%.

Conclusion

To summarize, interest-bearing notes involve explicit stated interest rates and can yield effectively differing rates depending on payment structures, while non-interest-bearing notes lack a stated interest rate but may still reflect implicit interest in their repayment structure. Understanding these distinctions is vital for evaluating the financial implications of each type of note. For additional understanding, resources like PwC Viewpoint can enhance knowledge on how these notes impact financial reporting and practices.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.