In Malaysia Is Commercial Property Rental Subject To Service Tax?

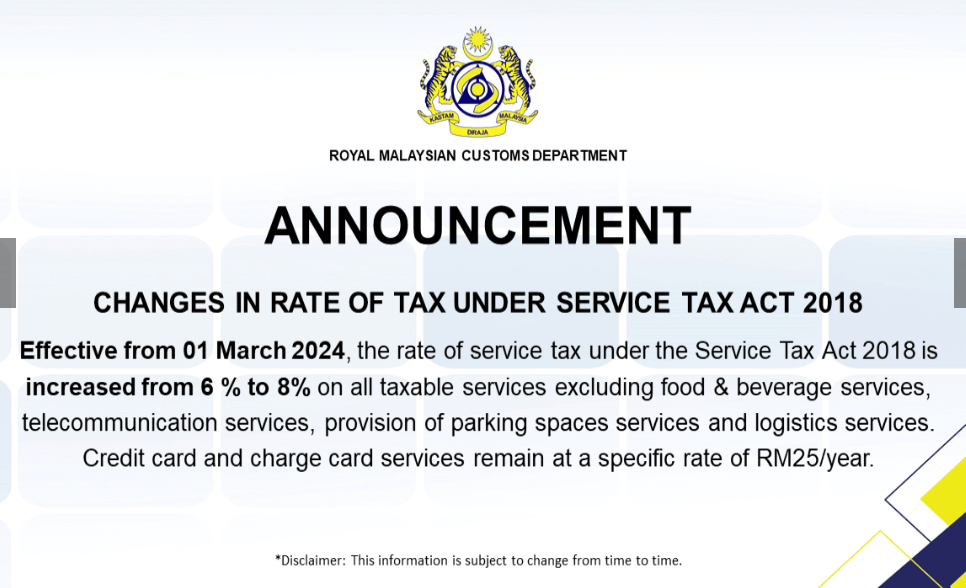

In Malaysia, commercial property rental is subject to service tax, specifically under the Sales and Service Tax (SST) framework. As of March 1, 2024, the service tax rate has been raised from 6% to 8%. This alteration applies broadly to various taxable services, with exceptions for specific sectors such as food & beverages and telecommunications.

Several sources provide further insight into this taxation landscape. For example, an overview of the service tax changes can be found in an article detailing the recent increases and expansions in tax scope on the BDO Global website. They highlight that the service tax has seen a significant change, which affects many services, including those linked to real estate and rentals. You can read more about this expansion here.

Additionally, HSBC highlighted in its discussion regarding the SST that various industries, including those dealing with commercial rentals, will be impacted by this tax increase. The specifics you can find in their article here.

For a comprehensive understanding of how these tax regulations affect rental income, including the liability and compliance aspects, you may refer to PropertyGuru's article discussing rental income tax in Malaysia here.

Overall, if you are dealing with commercial property rentals in Malaysia, it is essential to account for the service tax implications as of the new regulations coming into effect in 2024.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.