how much tax does elon musk pay

Elon Musk's tax payments have been a topic of considerable discussion and scrutiny over the years, particularly given his wealth and the tax strategies employed by his companies. Here’s a detailed summary based on recent reports.

In 2024, Tesla, Musk's electric car company, reportedly paid $0 in federal income taxes even though it recorded $2.3 billion in income. This development follows a trend where Tesla has managed to avoid substantial federal tax liabilities; over a span of three years, the company reported nearly $11 billion in U.S. income while paying only $48 million in federal taxes, resulting in an effective tax rate of just 0.4% (source: Kiplinger).

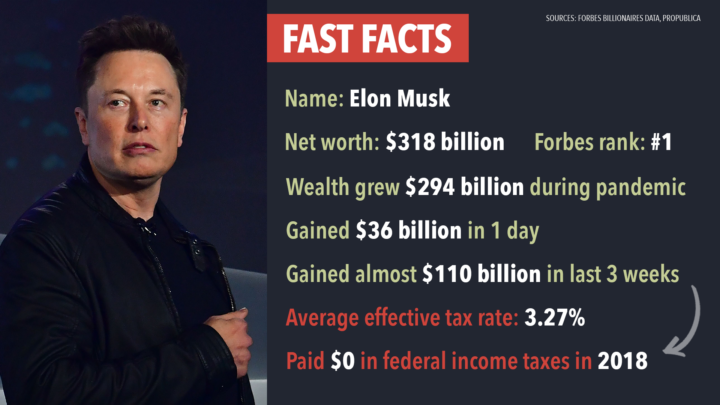

Despite these corporate tax scenarios, Musk himself claimed to have paid over $10 billion in taxes to the Internal Revenue Service (IRS) over the years, positioning himself as potentially the largest individual taxpayer in history. He even quipped about wishing the IRS would acknowledge him with a trophy for his contributions (source: IBTimes).

Historically, there has been significant debate about Musk's overall tax contributions relative to his wealth growth. Between 2014 and 2018, Musk's wealth increased by approximately $13.9 billion; during this timeframe, he paid around $455 million in federal income taxes, which translates to an effective tax rate of about 3.27% (source: Americans for Tax Fairness).

These instances highlight a broader conversation about tax policy, particularly with wealthy individuals and organizations exploiting loopholes to minimize tax obligations. Regardless, Musk maintains he has fulfilled a significant tax obligation, showcasing the complexities of taxation in relation to significant wealth accumulation.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.