How Much Does A Checking Account Cost? Visit Websites Of N9snY3N

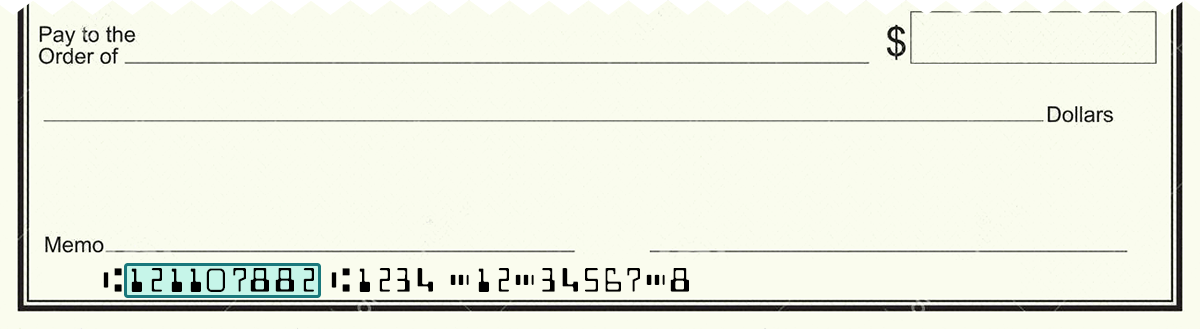

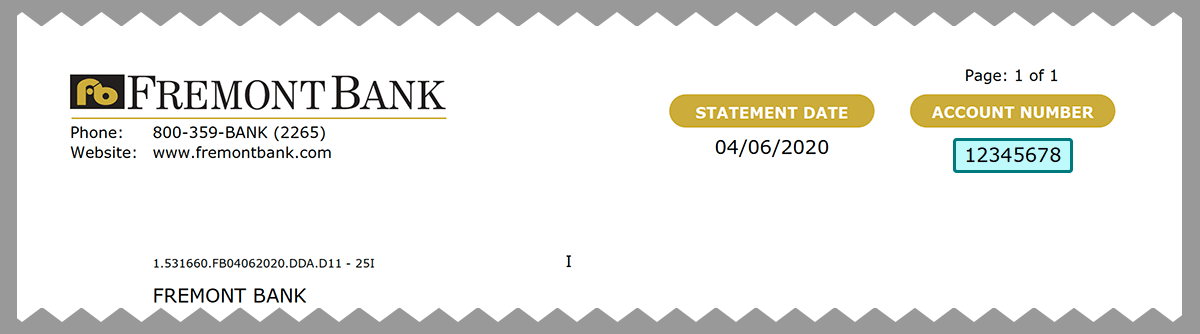

To evaluate the cost and services of checking accounts from Fremont Bank, Chase Bank, and Poppy Bank, it is essential to analyze the specific offerings and fees associated with each institution. Starting with Fremont Bank, they emphasize their checking accounts have no monthly service fees, but conditions may apply based on account linking or daily balance requirements. For instance, if linked to a specific business account, fees can be waived with a minimum balance of $1.00.

Next, Chase Bank typically has a monthly maintenance fee, which can be waived by meeting certain balance thresholds or deposit criteria, while also offering an array of services including online banking and check writing capabilities.

On the other hand, Poppy Bank positions itself as a more community-focused option. It often highlights lower fees and greater accessibility, especially for those who write fewer checks monthly and maintain a lower average balance.

To find the most economical choice, prospective customers should use resources like BankRate.com to compare not just monthly fees, but also transaction limits, interest-earning potential, and additional services like mobile banking access. Ultimately, users should crunch the numbers based on their personal banking habits, such as the number of checks they write and the balances they keep. Participating in a credit union might also provide an opportunity for lower fees and interest on checking accounts, presenting a viable alternative to traditional banks.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.