How Does A Job In Credit Anylising Relate To A

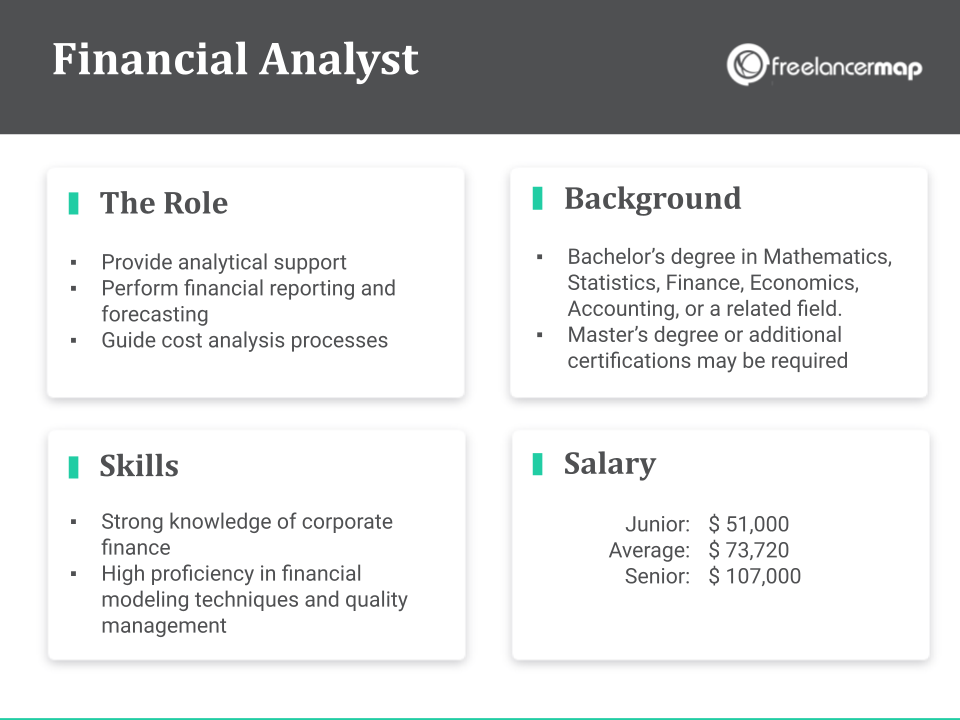

A credit analyst's main role is to evaluate financial data to determine the creditworthiness of individuals or companies. They are responsible for assigning credit ratings and assessing credit risk. This job requires strong financial analysis skills and involves tasks such as reviewing financial reports and conducting ratio analysis. Unlike financial analysts, credit analysts focus specifically on credit-related tasks rather than investment strategy.

A job in credit analysis relates to a fiscal analyst in the sense that both roles involve financial analysis. A credit analyst evaluates the creditworthiness of individuals or companies, assesses credit risk, and assigns credit ratings based on their financial data. On the other hand, a fiscal analyst is involved in analyzing the financial health and performance of organizations, typically government entities or corporations. Both roles require strong financial analysis skills and an understanding of financial statements and ratios. However, while credit analysts focus on creditworthiness and credit risk, fiscal analysts are concerned with broader financial aspects such as budgeting, forecasting, and financial planning for organizations.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.