Describe The 9 Firnancial Institutions And Their Importance. Provide Reference.

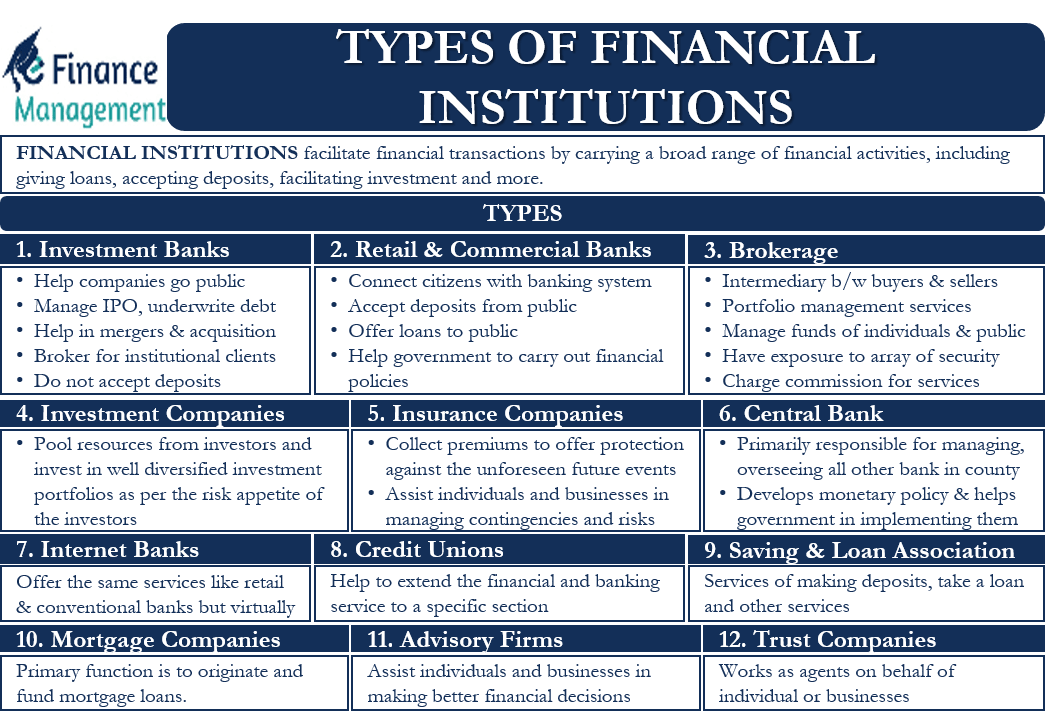

This text discusses the major categories of financial institutions, including central banks, retail and commercial banks, credit unions, savings and loan associations, investment banks, insurance companies, mortgage companies, brokerage firms, and internet banks in the UK. It explains that financial institutions are businesses that provide services to help people manage their money and may offer a variety of services such as banking, credit, and investments. The function of financial institutions includes banking services, capital formation, monetary supply regulation, pension fund management, and more. In the past, each type of financial institution had specific and limited services, but now they may offer a wider range of services.

Financial institutions play a crucial role in the economy by providing essential financial services. There are various types of financial institutions, each with its unique importance:

-

Central Banks: These institutions oversee monetary policy, regulate commercial banks, and manage a country's currency and foreign exchange reserves.

-

Retail and Commercial Banks: They provide a wide range of financial services to individuals, businesses, and governments, including savings and checking accounts, loans, and investment services.

-

Credit Unions: These cooperative institutions offer similar services to banks but are owned by their members, operating on a not-for-profit basis.

-

Savings and Loan Associations: These institutions specialize in accepting savings deposits and providing mortgage loans.

-

Investment Banks: They assist governments and corporations in raising capital through underwriting or acting as an intermediary in mergers and acquisitions.

-

Insurance Companies: These organizations provide protection against financial losses, offering various insurance products such as life, health, property, and casualty insurance.

-

Mortgage Companies: These entities specialize in providing home loans and mortgage-related services.

-

Brokerage Firms: They facilitate the buying and selling of financial securities, such as stocks, bonds, and mutual funds, for individual and institutional clients.

-

Internet Banks: These digital banks offer financial services exclusively through online or mobile platforms, providing greater convenience and often more competitive rates.

Financial institutions are essential for capital formation, managing monetary supply, facilitating transactions, and providing financial security through various products and services.

For a detailed reference, you can refer to various sources, including academic literature on finance, economics, and banking, as well as official websites of financial regulatory authorities and associations.

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.