complete journal entries and show calculation with debit and credit

Based on your query regarding journal entries and calculations for specified transactions, here are the completed journal entries reflecting the transactions along with the necessary debit and credit balances.

Journal Entries

-

August 1: Loan from Owner

- Debit: Cash $10,000

- Credit: Loan Payable $10,000

-

August 15: Prepaid Rent and Deposit

- Debit: Prepaid Rent $2,000

- Debit: Rent Expense $1,350

- Credit: Cash $3,350

-

August 31: Insurance Payment

- Debit: Prepaid Insurance $2,400

- Credit: Cash $2,400

-

September 1: Rent Expense

- Debit: Rent Expense $1,350

- Credit: Prepaid Rent $1,350

-

September 30: Sales of Bicycles and Golf Clubs

- Cash from Sales:

- Cash (15 bicycles at $150) = $2,250

- Cash (5 golf clubs at $350) = $1,750

- Total Cash = $4,000

- Accounts Receivable (12% of Total Sales)

- Total Sales = 15 * 150 + 5 * 350 = $5,000

- Accounts Receivable = $5,000 * 12% = $600

- Total Sales Revenue = $5,000

- Journal Entry:

- Debit: Cash $4,000

- Debit: Accounts Receivable $600

- Credit: Sales Revenue $5,000

- Cash from Sales:

-

September 30: Payroll Accrual

- Worked 12 hours at $15/hr = $180

- Debit: Payroll Expense $180

- Credit: Wages Payable $180

-

October 1: Rent Payment

- Debit: Rent Expense $1,350

- Credit: Cash $1,350

-

October 5: Payroll Payment

- Total Payroll from September 30 = $180

- Debit: Wages Payable $180

- Credit: Cash $180

-

October 15: Collection on Account

- Debit: Cash $500

- Credit: Accounts Receivable $500

-

October 20: Employee Payment

- Worked 20 hours at $15/hr = $300

- Debit: Payroll Expense $300

- Credit: Cash $300

-

October 31: Wage Accrual

- Worked 15 hours at $15/hr = $225

- Debit: Payroll Expense $225

- Credit: Wages Payable $225

-

October 31: Sales of Bicycles and Golf Clubs

- Cash from Sales:

- Cash (5 bicycles at $170) = $850

- Cash (15 golf clubs at $380) = $5,700

- Total Cash = $6,550

- Accounts Receivable (31% of Total Sales)

- Total Sales = 5 * 170 + 15 * 380 = $6,550

- Accounts Receivable = $6,550 * 31% = $2,020

- Total Sales Revenue = $6,550

- Journal Entry:

- Debit: Cash $4,550

- Debit: Accounts Receivable $2,020

- Credit: Sales Revenue $6,550

- Cash from Sales:

-

November 1: Rent Payment

- Debit: Rent Expense $1,350

- Credit: Cash $1,350

-

November 5: Payroll Payment

- Payroll from October Accrued = $225

- Debit: Wages Payable $225

- Credit: Cash $225

-

November 17: Collection on Account

- Debit: Cash $950

- Credit: Accounts Receivable $950

-

November 20: Employee Payment

- Worked 17 hours at $15/hr = $255

- Debit: Payroll Expense $255

- Credit: Cash $255

-

November 30: Wage Accrual

- Worked 22 hours at $15/hr = $330

- Debit: Payroll Expense $330

- Credit: Wages Payable $330

-

November 30: Sales of Bicycles and Golf Clubs

- Cash from Sales:

- Cash (15 bicycles at $170) = $2,550

- Cash (10 golf clubs at $380) = $3,800

- Total Cash = $6,350

- Accounts Receivable (28% of Total Sales)

- Total Sales = 15 * 170 + 10 * 380 = $6,350

- Accounts Receivable = $6,350 * 28% = $1,778

- Total Sales Revenue = $6,350

- Journal Entry:

- Debit: Cash $4,550

- Debit: Accounts Receivable $1,778

- Credit: Sales Revenue $6,350

- Cash from Sales:

-

December 1: Rent Payment

- Debit: Rent Expense $1,350

- Credit: Cash $1,350

-

December 5: Payroll Payment

- Payroll from November Accrued = $255

- Debit: Wages Payable $255

- Credit: Cash $255

-

December 18: Received Payments on Accounts

- Debit: Cash $1,000

- Credit: Accounts Receivable $1,000

-

December 20: Employee Payment

- Worked 16 hours at $15/hr = $240

- Debit: Payroll Expense $240

- Credit: Cash $240

-

December 31: Wage Accrual

- Worked 18 hours at $15/hr = $270

- Debit: Payroll Expense $270

- Credit: Wages Payable $270

-

December 31: Sales of Bicycles and Golf Clubs

- Cash from Sales:

- Cash (20 bicycles at $180) = $3,600

- Cash (5 golf clubs at $400) = $2,000

- Total Cash = $5,600

- Accounts Receivable (22% of Total Sales)

- Total Sales = 20 * 180 + 5 * 400 = $5,600

- Accounts Receivable = $5,600 * 22% = $1,232

- Total Sales Revenue = $5,600

- Journal Entry:

- Debit: Cash $5,600

- Debit: Accounts Receivable $1,232

- Credit: Sales Revenue $5,600

- Cash from Sales:

-

December 31: Insurance Expense for September-December

- Insurance for 4 months out of 12 = $2,400 / 12 * 4 = $800Here's a detailed summary of the journal entries required for the specified transactions, formatted to show both debit and credit balances.

Journal Entries

1. Loan to Company

- Date: August 1

- Debit: Cash $10,000

- Credit: Loan Payable $10,000

2. Lease Agreement and Initial Rent Payment

- Date: August 15

- Debit: Prepaid Rent $2,000

- Debit: Rent Expense $1,350

- Credit: Cash $3,350

3. Insurance Payment

- Date: August 31

- Debit: Prepaid Insurance $2,400

- Credit: Cash $2,400

4. September Rent Expense

- Date: September 1

- Debit: Rent Expense $1,350

- Credit: Prepaid Rent $1,350

5. Sales Transactions (Bicycles and Golf Clubs)

- Date: September 30

- With Customers on Account:

- Debit: Accounts Receivable $(15 bicycles × $150 × 12%) + (5 golf clubs × $350 × 12%)

- Credit: Sales Revenue (15 × $150 + 5 × $350)

- Cash Payment:

- Debit: Cash [remaining balance]

- With Customers on Account:

6. Payroll Accrual

- Calculation: 12 hours × $15/hour = $180

- Date: September 30

- Debit: Payroll Expense $180

- Credit: Accrued Wages Payable $180

7. Paid October Rent

- Date: October 1

- Debit: Rent Expense $1,350

- Credit: Cash $1,350

8. Employee Pay for September Period

- Date: October 5

- Debit: Wages Expense $180

- Credit: Cash $180

9. Collection on Accounts

- Date: October 15

- Debit: Cash $500

- Credit: Accounts Receivable $500

10. Employee Pay for October Period

- Calculation: 20 hours × $15 = $300

- Date: October 20

- Debit: Wages Expense $300

- Credit: Cash $300

11. Payroll Accrual for October

- Date: October 31

- Debit: Payroll Expense $225 (15 hours × $15)

- Credit: Accrued Wages Payable $225

12. Sales Transactions for October

- Date: October 31

- On Account:

- Debit: Accounts Receivable $(5 bicycles × $170 × 31%) + (15 golf clubs × $380 × 31%)

- Credit: Sales Revenue (5 × $170 + 15 × $380)

- Cash Payment:

- Debit: Cash [remaining balance]

- On Account:

13. Payment for November Rent

- Date: November 1

- Debit: Rent Expense $1,350

- Credit: Cash $1,350

14. Employee Pay for October Period

- Date: November 5

- Debit: Wages Expense $225

- Credit: Cash $225

15. Collection on Accounts

- Date: November 17

- Debit: Cash $950

- Credit: Accounts Receivable $950

16. Employee Pay for November Period

- Date: November 20

- Debit: Wages Expense $255 (17 hours × $15)

- Credit: Cash $255

17. Payroll Accrual for November

- Date: November 30

- Debit: Payroll Expense $330 (22 hours × $15)

- Credit: Accrued Wages Payable $330

18. Sales Transactions for November

- Date: November 30

- On Account:

- Debit: Accounts Receivable $(15 bicycles × $170 × 28%) + (10 golf clubs × $380 × 28%)

- Credit: Sales Revenue (15 × $170 + 10 × $380)

- Cash Payment:

- Debit: Cash [remaining balance]

- On Account:

19. Payment for December Rent

- Date: December 1

- Debit: Rent Expense $1,350

- Credit: Cash $1,350

20. Employee Pay for November Period

- Date: December 5

- Debit: Wages Expense $255

- Credit: Cash $255

21. Collection on Accounts

- Date: December 18

- Debit: Cash $1,000

- Credit: Accounts Receivable $1,000

22. Employee Pay for December Period

- Date: December 20

- Debit: Wages Expense $240 (16 hours × $15)

- Credit: Cash $240

23. Payroll Accrual for December

- Date: December 31

- Debit: Payroll Expense $270 (18 hours × $15)

- Credit: Accrued Wages Payable $270

24. Sales Transactions for December

- Date: December 31

- On Account:

- Debit: Accounts Receivable $(20 bicycles × $180 × 22%) + (5 golf clubs × $400 × 22%)

- Credit: Sales Revenue (20 × $180 + 5 × $400)

- Cash Payment:

- Debit: Cash [remaining balance]

- On Account:

25. Insurance Expense for September 1 - December 31

- Date: December 31

- Debit: Insurance Expense $800 (4 months at $2,400/12)

- Credit: Prepaid Insurance $800

26. Interest Accrual on Loan

- Calculation: $10,000 × 4% × (5 months) = $167.67

- Date: December 31

- Debit: Interest Expense $167.67

- Credit: Interest Payable $167.67

Finalizing the Journal Entries and Balances

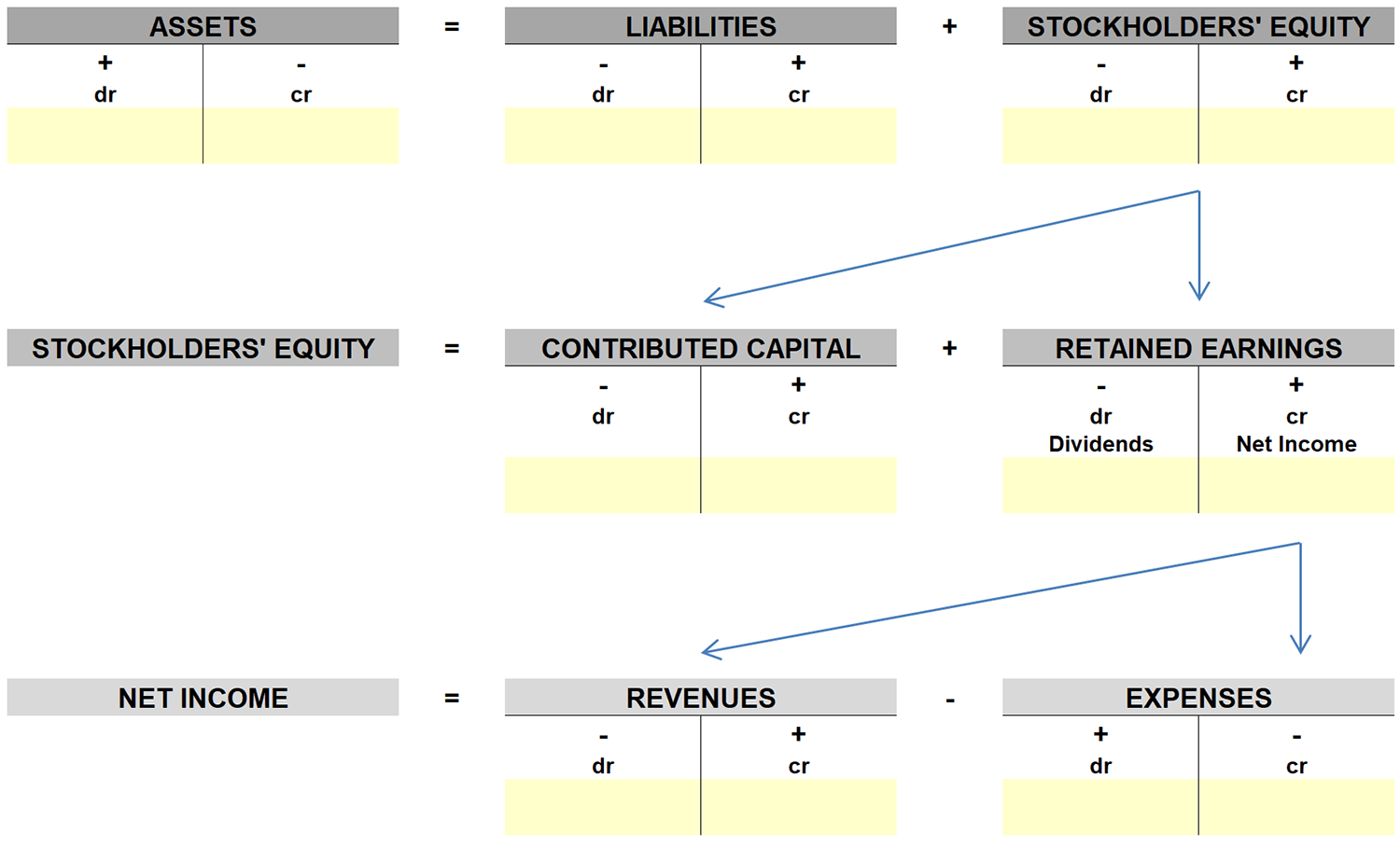

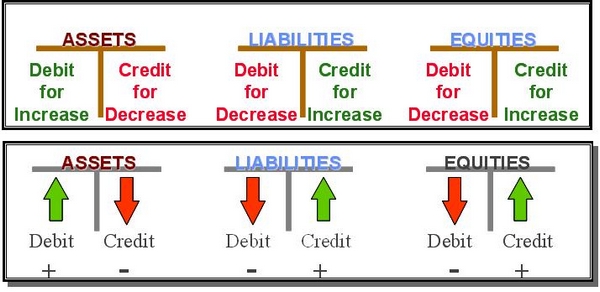

At the end of the reporting period, the total debits must equal the total credits in your accounts. You can find out each totals and confirm they balance before proceeding to the next step in your accounting.

The links included above offer additional information on how to correctly format and record journal entries, including debit and credit calculations which you may find helpful for more details:

- Debits and Credits Overview

- How to Calculate Debit and Credit Balances

- Accounting Journal Entries Guide

Overall, each of these entries provides a comprehensive record of

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.