Compare and contrast the data offerings for Yardi, CoStar, RCA,

Comparison of Data Offerings: Yardi, CoStar, RCA, and Dunn & Bradstreet

When it comes to commercial real estate (CRE) data offerings, Yardi, CoStar, RCA, and Dunn & Bradstreet each offer distinct features, strengths, and functionality. Here’s a detailed comparison of their offerings:

1. Yardi

Yardi provides comprehensive software and data solutions tailored for property management, investment management, and asset management across various real estate sectors. Its key offerings include:

- Yardi Matrix: This platform focuses on market intelligence for apartments, including metrics on rent, occupancy rates, and competitive positioning through their proprietary rating system.

- Data Integration: Yardi integrates property management and operational data, which enables clients to manage properties effectively and derive insights for strategic decision-making.

- Analytics and Reporting: It offers robust reporting tools that are being enhanced to move away from traditional Crystal reports towards more dynamic reporting options like SQL and SSRS.

Overall, Yardi emphasizes a comprehensive ecosystem that enables users to streamline operations while utilizing robust market data for professional analysis. Learn more about Yardi's offerings here.

2. CoStar

CoStar is well-known as a leader in commercial real estate data analytics. Its offerings include:

- Extensive Database: CoStar has one of the largest repositories of commercial property data, including detailed property information, transaction history, and tenant leases. This is crucial for investors and brokers looking for comprehensive market data.

- Market Analytics: The platform offers sophisticated analytics tools that support in-depth market comparisons, market forecasts, and visual data presentations, which can aid in strategic planning and investment decisions.

- Real-Time Updates: CoStar is renowned for its up-to-date reporting, ensuring users have access to the latest market trends and insights.

In summary, CoStar prioritizes depth in data and analytics, providing its users an edge in investment and market assessment.

3. Real Capital Analytics (RCA)

Real Capital Analytics specializes in transaction data and capital market information in the commercial real estate sector:

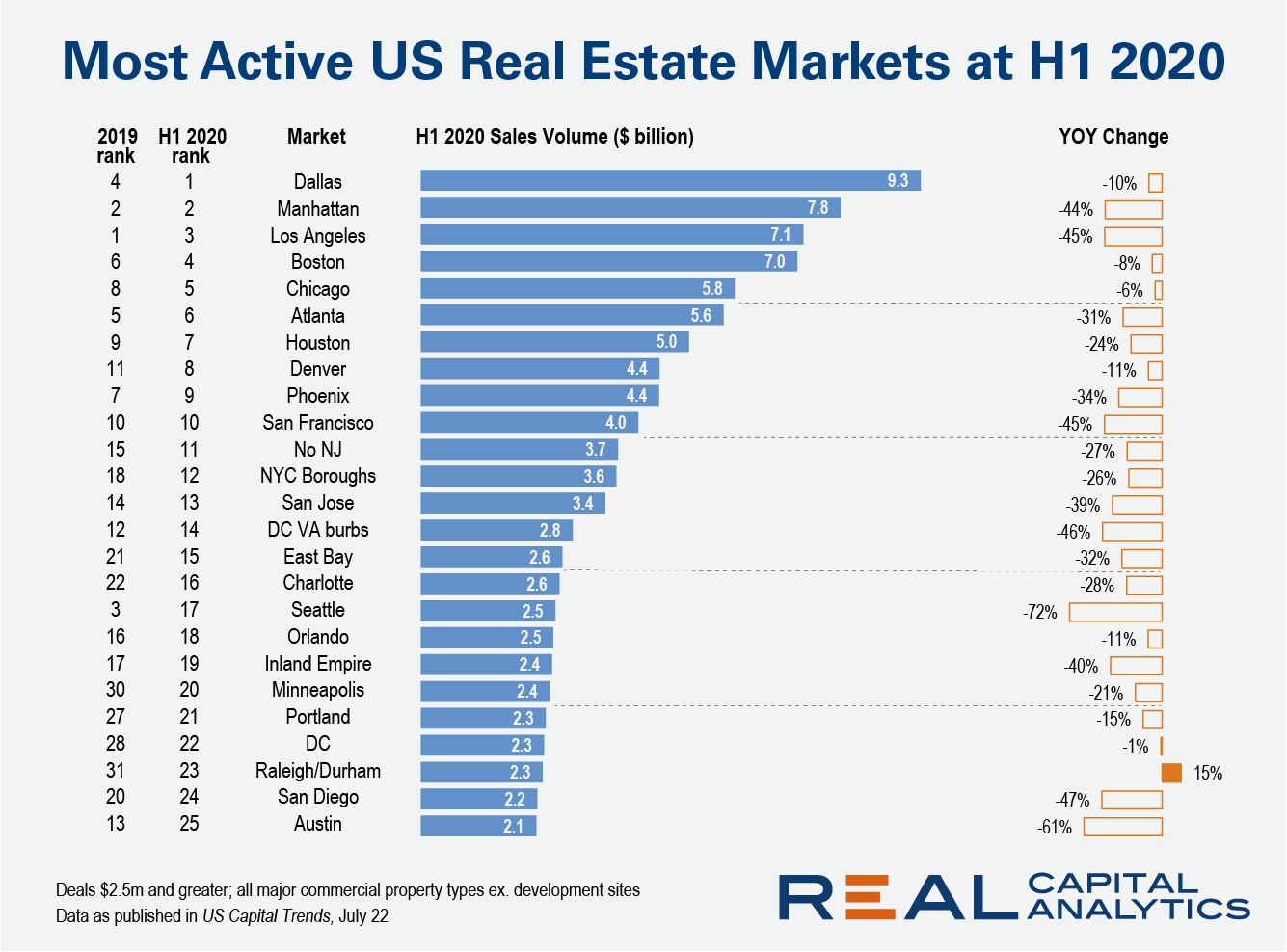

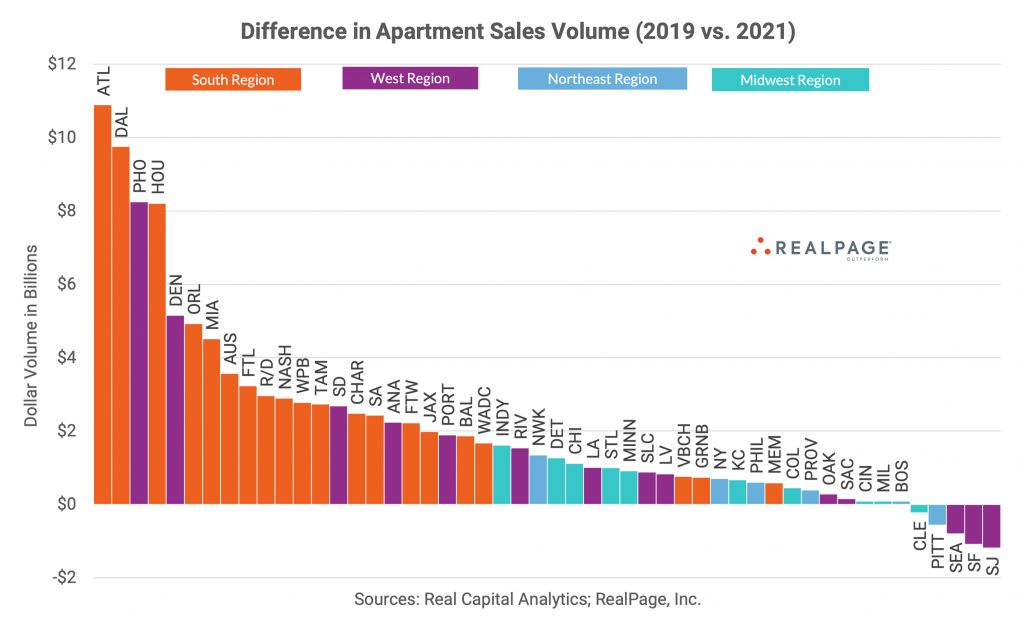

- Transaction Focus: RCA is primarily known for its detailed tracking and analysis of commercial property transactions, making it an indispensable tool for investment professionals keeping tabs on market movements.

- Market Intelligence: The platform provides insights on property sales, capital flows, and investment trends, featuring high-quality data around cross-border investments and transaction volumes.

- Valuation Analysis: RCA assists in valuing properties through comparable sales data and metrics which are crucial for appraisers and real estate agents.

RCA is favored for its laser focus on buying and selling trends, thus providing critical insights for investors.

4. Dunn & Bradstreet

Dunn & Bradstreet does not focus exclusively on commercial real estate but provides extensive business data which can be applied to various sectors, including CRE:

- Business Data Services: D&B offers data on business credit, financial health, and operational performance, making it useful for CRE professionals looking to assess tenant or partner viability.

- Data Analysis and Insights: Their services can provide insights into credit risk, which can aid in decision-making for leasing and investment purposes.

- Custom Reporting Tools: Dunn & Bradstreet provides various reporting tools that allow users to generate custom insights based on their specific needs.

While D&B's offerings are broader and not exclusively centered on CRE, they can supplement real estate professionals with important business health metrics relevant to investment choices.

Conclusion

In summary, each of these platforms has unique advantages suited for specific needs within the commercial real estate sector. Yardi excels in property management integration and operational metrics, CoStar offers a deep well of property and market analytics, RCA specializes in transaction data and capital trends, and Dunn & Bradstreet provides broader business insights that can greatly aid investment decisions in the CRE landscape. Choosing the right platform will depend on the specific requirements of the user—from operational management to investment analysis, each tool serves a crucial role.Comparison of Data Offerings for Yardi, CoStar, RCA, and Dunn & Bradstreet

When considering the data offerings from Yardi, CoStar, Real Capital Analytics (RCA), and Dunn & Bradstreet (D&B), it's essential to understand how they cater to the commercial real estate (CRE) sector, the types of data they provide, and their unique features.

1. Yardi

Yardi is primarily known for its comprehensive property management and investment management software.

-

Key Offerings:

- Property Management: Integrated software solutions that provide tools for portfolio management, lease tracking, and tenant relations.

- Market Analytics: Yardi Matrix offers data on property performance, market trends, and a proprietary Context® rating system to facilitate property comparisons.

- Investment Management: Solutions aimed at asset management, financial analytics, and reporting capabilities are designed for investors.

-

Unique Features:

- Yardi focuses on providing a user-friendly interface that supports property managers and investors in making informed decisions based on real-time data.

Learn more about Yardi’s offerings.

2. CoStar

CoStar is renowned for its extensive commercial real estate database, which includes various types of market data.

-

Key Offerings:

- Market Analytics: Powerful tools for analyzing CRE trends, vacancy rates, and rental rates.

- Benchmarking: High-frequency data that allows users to compare property performance across multiple segments.

- Sales and Lease Comps: Access to a vast repository of sales and lease transactions, which is crucial for appraisers and investors.

-

Unique Features:

- CoStar’s analytics capabilities provide deep insights into market movements, making it a preferred choice for analysts and brokers who require granular data.

Explore CoStar’s data offerings.

3. Real Capital Analytics (RCA)

RCA specializes in transactional data, particularly in regard to commercial real estate investments.

-

Key Offerings:

- Transaction Data: In-depth data on commercial property sales, including pricing, cap rates, and ownership details.

- Market Insights: Reports and analyses that cover market trends and investment opportunities on a national and regional basis.

-

Unique Features:

- RCA is recognized for its focus on investment sales data and market analysis, catering specifically to institutional investors and analysts.

4. Dunn & Bradstreet (D&B)

D&B is known for its extensive business database, which includes valuable commercial real estate insights.

-

Key Offerings:

- Business Intelligence: Comprehensive data on businesses that own, manage, or invest in real estate.

- Risk Management Solutions: Tools for assessing the financial health of potential business partners or clients.

- Data Analytics: Data-driven insights that help in making informed business decisions related to the commercial real estate sector.

-

Unique Features:

- D&B’s strength lies in its wide-ranging business information and credit risk analysis, offering a different perspective compared to dedicated real estate platforms.

Discover more about Dunn & Bradstreet;

Comparison Summary

- Target Audience: Yardi is tailored for property management and investment, CoStar is for deep market analytics, RCA focuses on transaction data for investors, and D&B provides broad business intelligence and risk assessment.

- Data Types: Yardi emphasizes property management metrics, CoStar provides comprehensive market analytics and benchmarking, RCA specializes in transaction details, while D&B offers business-level insights that affect the CRE landscape.

- Use Cases: Each platform serves distinct purposes, from operational management in Yardi, strategic analysis in CoStar and RCA, to risk assessment and business intelligence in D&B.

In conclusion, while all four companies provide valuable data in the commercial real estate space, they approach the market from different angles tailored to various user needs.Here’s a detailed comparison of the data offerings provided by Yardi, CoStar, Real Capital Analytics (RCA), and Dunn & Bradstreet, highlighting their key features, strengths, and usability in the commercial real estate (CRE) sector.

Yardi

Yardi offers a comprehensive suite of property management and investment management solutions designed for various real estate verticals. Key data offerings from Yardi include:

- Yardi Matrix: This product provides integrated property management tools and an extensive database for market analysis. It features a unique Context® rating system for like-for-like property comparisons, which aids in understanding market dynamics more efficiently.

- Integrated Solutions: Yardi includes both property management and analytical tools, streamlining operations for real estate professionals. Their focus on providing a singular solution for management, accounting, and tenant services distinguishes them in the market.

- Market Intelligence: Users benefit from access to real-time market analytics, occupancy data, and performance benchmarks across different real estate sectors. Learn more here.

CoStar

CoStar is well-known as a leading provider of commercial real estate data and analytics. Its offerings include:

- Vast Database: CoStar possesses an extensive database that includes detailed sales and lease comps, property listings, and vacancy rates, enabling users to conduct thorough market analyses.

- Market Analytics: The platform offers powerful analytics tools allowing users to assess market trends and forecast future performance with high-level granularity, making it ideal for investment decisions.

- Benchmarking Tools: Real-time benchmarking tools enable users to compare property performance across different segments, which can be crucial for competitive analysis. CoStar is regularly praised for its completeness and accuracy in data offerings. Discover more here.

Real Capital Analytics (RCA)

RCA specializes in capital markets data, focusing on investment analysis within the CRE sector. Its key offerings include:

- Transaction Data: RCA is primarily known for its comprehensive transaction data, which tracks sales volume, pricing, and yield across different property sectors.

- Market Visualizations: The platform provides visualization tools for pricing and volume data to facilitate detailed market insights and comparisons at both granular and macro levels.

- Investment Trends: RCA focuses heavily on identifying trends in capital flows and investment volumes, making it a valuable resource for investors and analysts looking to understand market movements. Find more information here.

Dunn & Bradstreet

Dunn & Bradstreet (D&B) excels in providing business data and analytics that help organizations make informed decisions. Key data features include:

- Business Insights: D&B provides extensive business records, credit reports, and risk assessments for businesses, which can be essential for investors considering partnerships or investments in CRE ventures.

- Commercial Data Solutions: Their offerings include market intelligence tools that help users leverage business data in real estate decision-making processes, focusing on creditworthiness and business performance.

- Robust Networking: The breadth of data covered by D&B enables a tight network for understanding industry trends, which is beneficial for businesses looking to cooperate within the real estate market. Explore more on D&B’s offerings.

Comparison Summary

In conclusion, Yardi stands out for its integrated management and property data solutions, ideal for on-the-ground operational needs. CoStar, on the other hand, is lauded for its extensive market analytics and comprehensive data offering, making it a top choice for real estate professionals focused on investment strategies. RCA is best known for its focus on capital flows and transaction data, providing insights specifically for investment and finance-centric CRE analysis. Dunn & Bradstreet provides broader business intelligence and risk management tools, making it practical for understanding the market landscape from a financial perspective.

Each platform has its unique strengths, making the choice dependent on the specific needs and focus areas of the users within the commercial real estate field.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.