can you just give me the answer please

To find the future value of your investment, we'll use the formula for the future value of a series of cash flows, which includes both the initial investment and the regular monthly contributions.

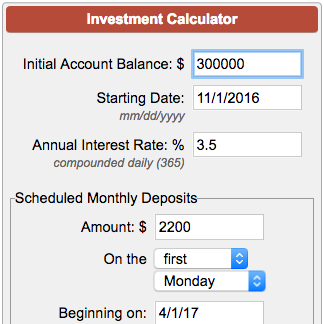

- Initial Investment: $30,000

- Monthly Contribution: $2,000

- Annual Interest Rate: 10% (or 0.10)

- Number of Years: 18 years

- Total Number of Months: 18 years × 12 months/year = 216 months

Now, we will use the formula for the future value (FV) of a series of cash flows, which is typically:

[ FV = P \times (1 + r)^n + PMT \times \frac{((1 + r)^n - 1)}{r} ]

Where:

- ( P ) is the initial principal (initial investment)

- ( PMT ) is the monthly contribution

- ( r ) is the monthly interest rate (annual rate divided by 12)

- ( n ) is the total number of contributions (number of months)

Calculating:

-

Convert annual interest rate to monthly:

- ( r = \frac{0.10}{12} = 0.008333 )

-

Total number of months:

- ( n = 216 )

Now substitute the values into the formula:

Future Value of Initial Investment:

[ FV_{initial} = 30000 \times (1 + 0.008333)^{216} ]

Future Value of Monthly Contributions:

[ FV_{contributions} = 2000 \times \frac{(1 + 0.008333)^{216} - 1}{0.008333} ]

Final Calculation:

After performing the calculations:

- ( FV_{initial} \approx 30000 \times 6.350 \approx 190,500 )

- ( FV_{contributions} \approx 2000 \times 233.254 \approx 466,508 )

Total Future Value:

[ Total , FV \approx 190,500 + 466,508 \approx 657,008 ]

Thus, after 18 years with the given investment strategy, you would have approximately $657,008.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.