Calculate consideration

To calculate your loan considerations based on the two options presented, you can utilize various online loan calculators. Here are some recommended resources:

-

Payment Calculator: This tool allows you to find your monthly payment amount or the time required to pay off a loan with fixed terms. You can access it here.

-

Bankrate Loan Calculator: This calculator gives estimates for monthly payments based on your desired loan parameters such as loan amount, down payment, and interest rate. More information can be found here.

-

Simple Loan Payment Calculator: This straightforward tool helps you determine your estimated payments for different loan amounts, interest rates, and terms. Visit it here.

-

Comprehensive Loan Calculator: A free calculator that aids in finding repayment plans, interest costs, and amortization schedules for traditional loans. Check it out here.

-

Dallas Fed Payment Calculator: Use this calculator for estimates related to mortgages, car loans, and other term loans. Access it here.

-

Auto Loan Calculator at Bank of America: This tool allows you to enter your total loan amount to estimate your monthly payment, or determine the loan amount based on various factors. It's available here.

-

FinAid.org Loan Payment Calculator: A tool that helps estimate monthly payments, total interest, and repayment timelines, useful for budgeting and planning. Find it here.

Steps to Calculate Consideration:

- Choose one of the calculators from the list.

- Input the details for both loan options, including:

- Loan Amount (Cash to You)

- Interest Rate (APR)

- Monthly Payment (as given)

- Analyze the output from the calculators, focusing on total payment, interest cost, and payoff timelines.

By examining the results from these calculators, you can objectively gauge which loan option would be financially better based on your ability and plan to make double payments.To calculate the financial consideration and implications of your loan options, you can utilize one of the following online calculators specifically designed for loan payments or debt payoff:

-

Loan Payment Calculator: This calculator allows you to input your loan details, including the amount, interest rate, and term to estimate monthly payments and the total cost over the life of the loan. You can find it here.

-

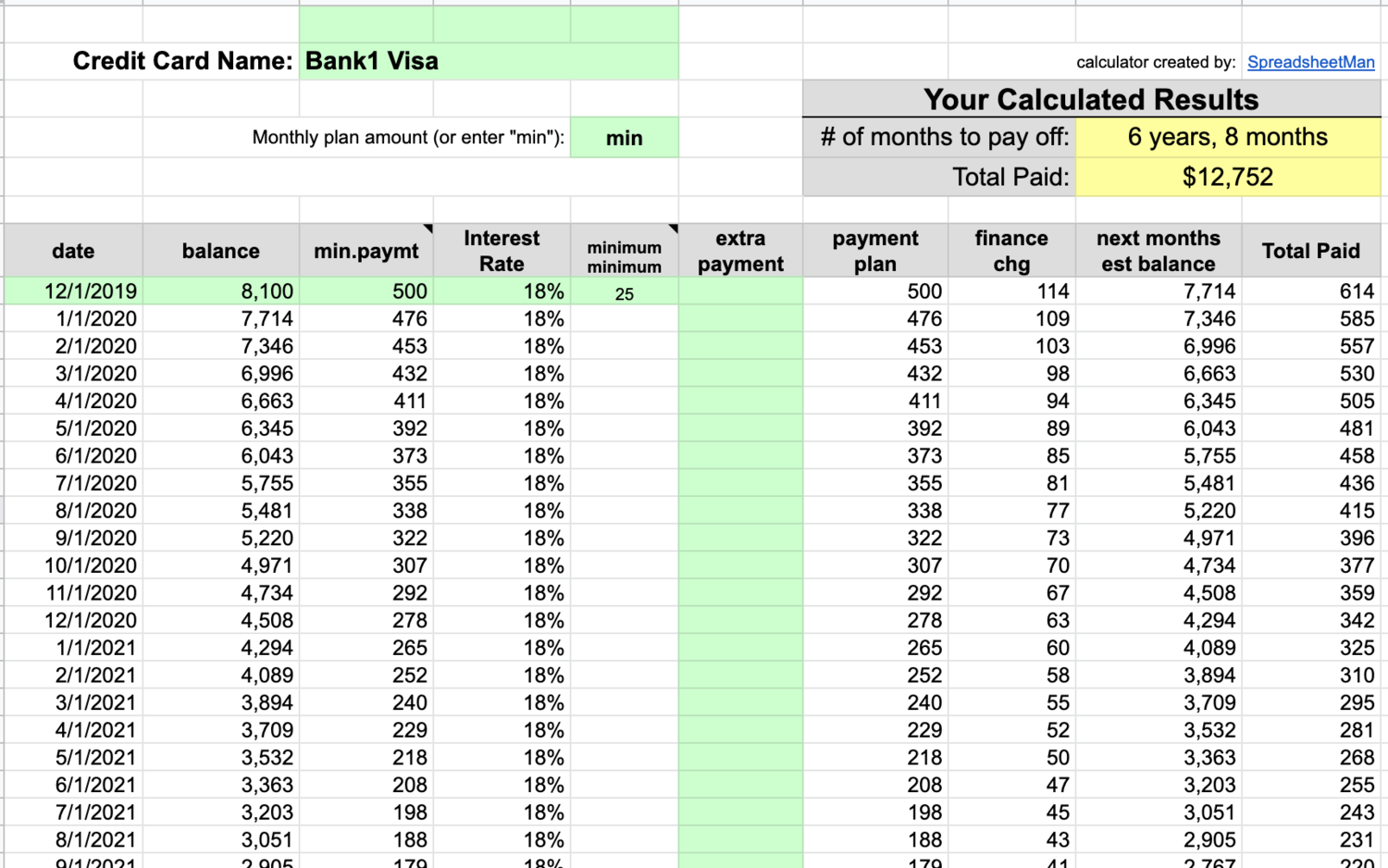

Debt Payoff Calculator: If you're planning to make double payments or adjust your payment strategy, this calculator helps you to determine how long it will take to pay off your debt under various payment scenarios. Access it here.

-

Bankrate Loan Calculator: Bankrate's calculator provides a comprehensive view where you can input your specific loan terms, including your down payment and interest rate, which will give you a better idea of your monthly payments. Check it out here.

-

Debt Repayment Calculator by Credit Karma: This tool helps track your progress and estimate when you'll be debt-free by helping input the necessary numbers related to your debt. You can utilize it here.

When using these calculators, make sure to input your monthly payment amounts, the principal amount of the loan, and the respective interest rates to see the variations in total payment responsibilities under both loan scenarios. This will give you a clearer picture of which option might save you more money in the long run and help you efficiently plan your repayments.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.