are cleaning services tax deductable

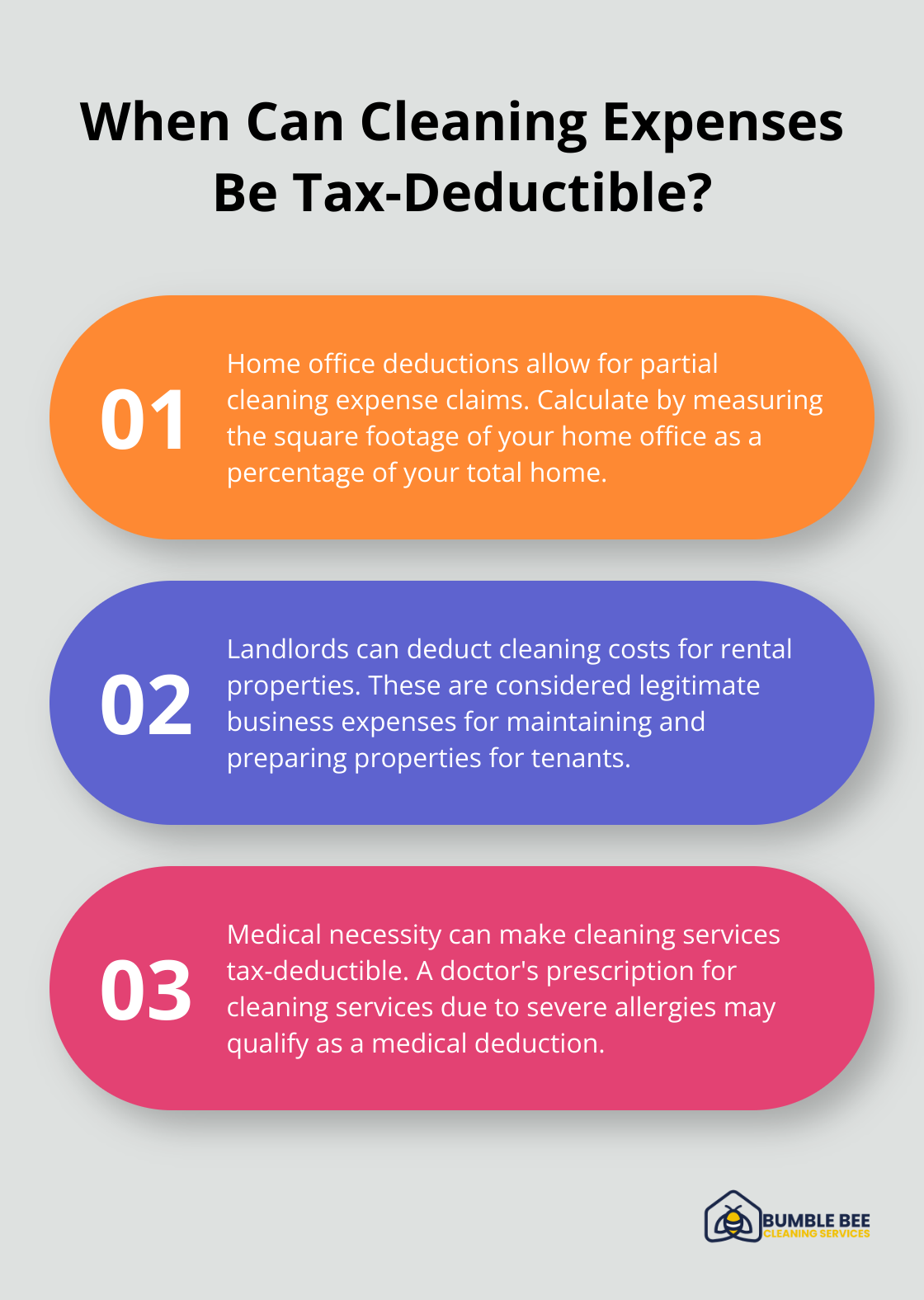

Yes, cleaning services can be tax deductible, but there are specific conditions under which you can claim these deductions.

-

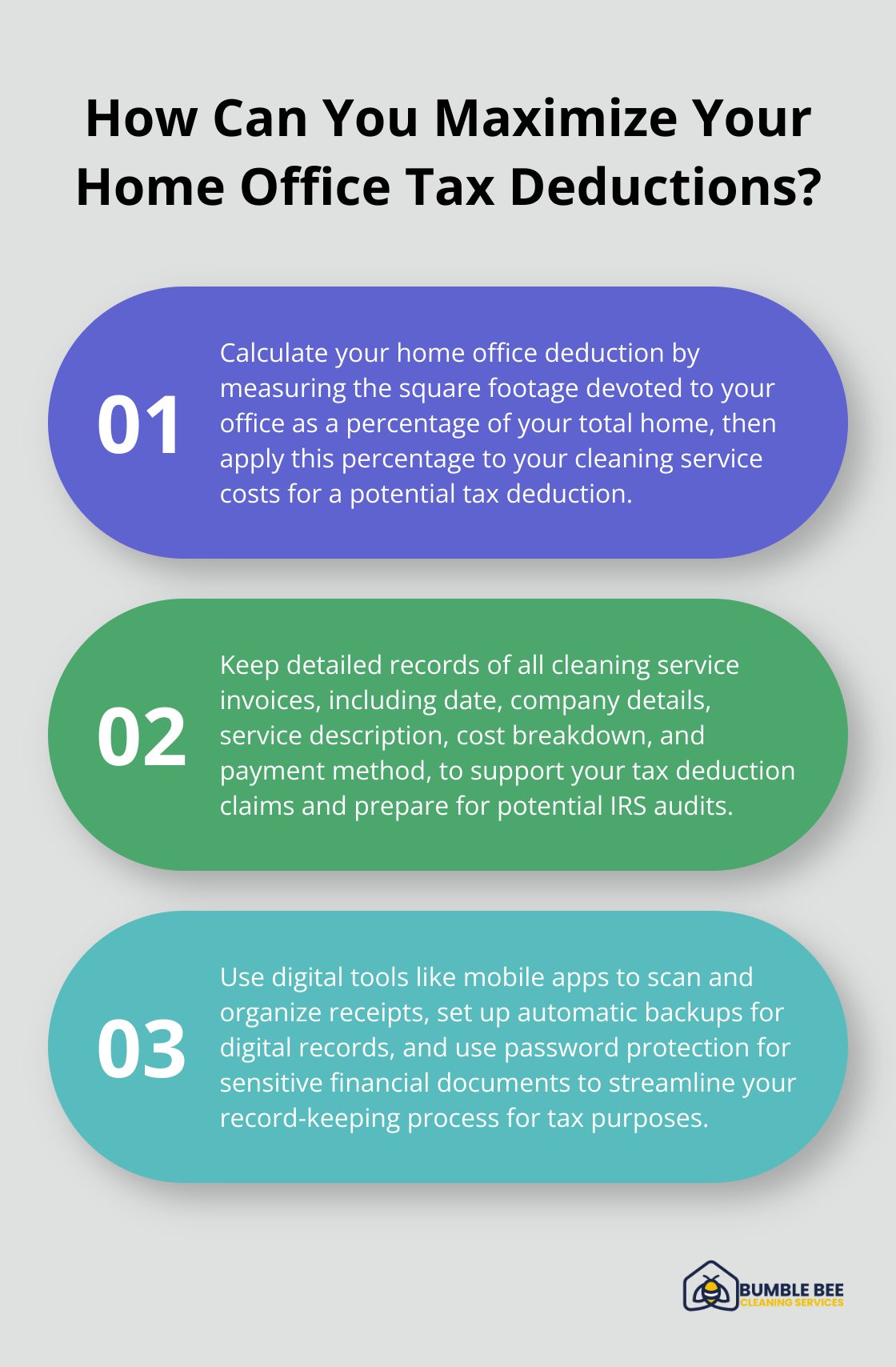

For Home Offices: If you have a designated home office that qualifies under IRS guidelines, you can deduct a portion of the cleaning services related to that space. For example, if your home office makes up 10% of your total home square footage, you can deduct 10% of the cost of cleaning services. This includes regular cleaning, as well as cleaning supplies used in the home office.

-

For Self-Employed Individuals or Cleaning Business Owners: If you operate a cleaning business, you can deduct the costs associated with cleaning services and supplies as business expenses on your tax return. This includes cleaning equipment, supplies, and possibly even subcontractor services if you hire other cleaners.

-

Ordinary and Necessary Expenses: The IRS allows deductions for ordinary and necessary expenses for self-employed individuals. If cleaning services are required for maintaining business premises or supplies, they can be claimed as deductions.

For more detailed information about deducting cleaning services, you can refer to the following resources:

- Are House Cleaning Services Tax Deductible in USA?

- 10 House Cleaner & Cleaning Business Tax Deductions

- 5 Tax Tips for Housekeepers from TurboTax

- 10 Tax Deductions for Cleaning Businesses

Always consult with a tax professional or financial advisor to ensure that you are adhering to the latest tax laws and maximizing your deductions correctly.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.