Approximate the net amount based on me making $400000 per

To estimate the net amount from your $60,000 bonus, given your annual income of $400,000, we need to consider both New York State and New York City income tax rates for 2025.

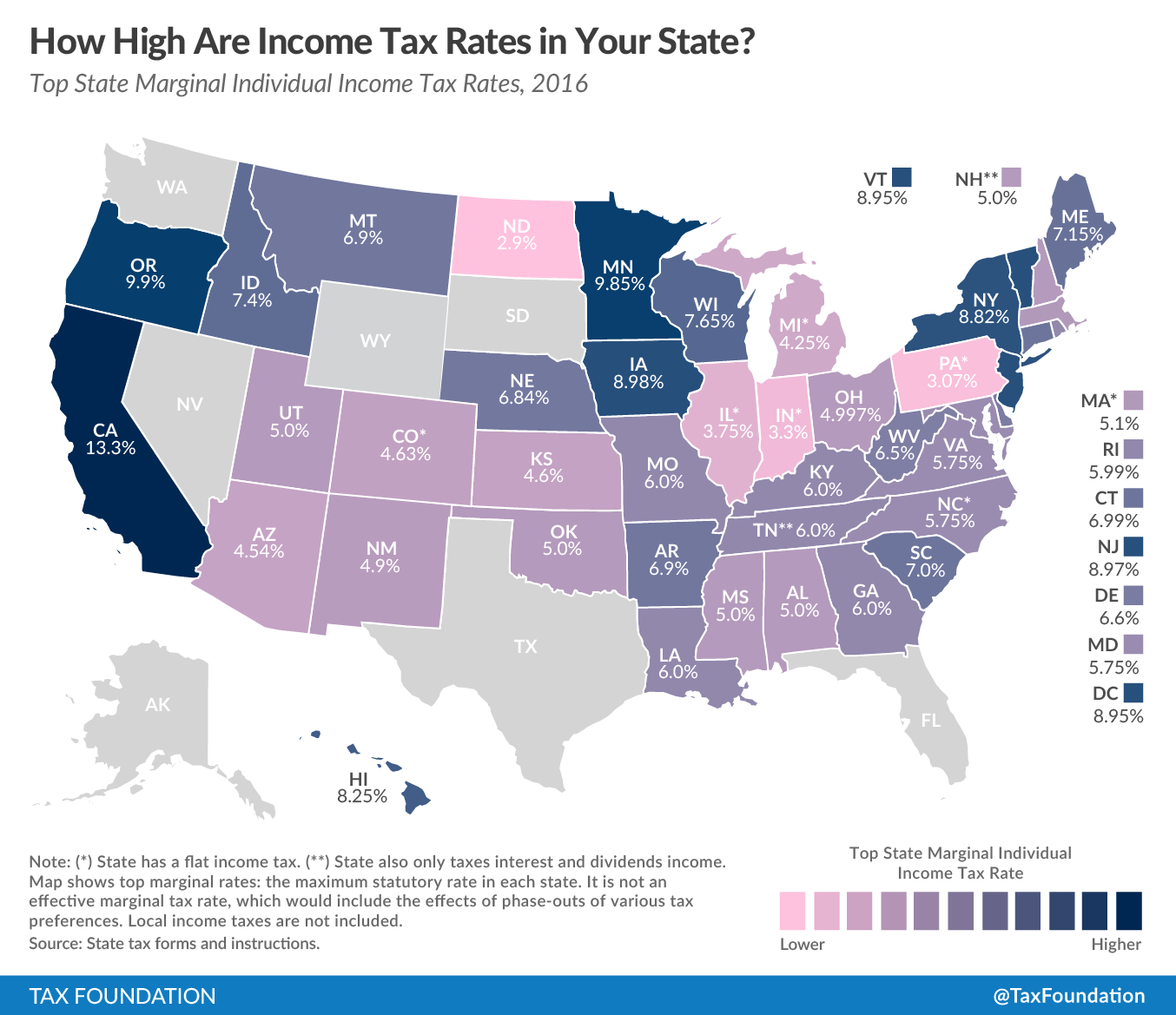

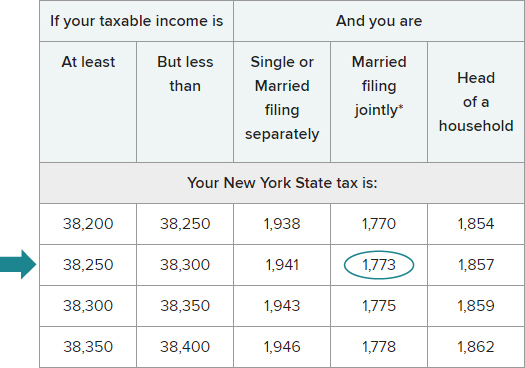

New York State Income Tax

New York State has tax rates ranging from 4% to 10.9%. For your income level ($400,000), you will fall into higher tax brackets. The relevant state tax brackets for your income range include:

- 4% on income up to $8,500

- 4.5% on the next $3,250

- 5.25% on the next $1,500

- 5.9% on the next $48,000

- 6.85% on the next $11,500

- 9.65% on the next $3 million (your bonus will only be taxed beyond the $400,000 threshold)

New York City Income Tax

For NYC residents, the tax brackets include:

- 3.078% on income up to $12,000

- 3.762% on the next $13,000

- 3.819% on the income above $25,000.

Total Estimate for Bonus

For simplicity, let’s estimate a combined effective tax rate for your bonus:

- State Taxes: You could estimate an effective rate around 6.9% due to your high income.

- City Taxes: A conservative estimate of around 3.876% can be used.

Calculation:

- Total Tax Rate (Approximate): 6.9% (state) + 3.876% (city) = about 10.776%.

- Total Tax on Bonus: $60,000 * 10.776% = approximately $6,466.

- Net Bonus Amount: $60,000 - $6,466 ≈ $53,534.

Additional Considerations

- These calculations do not take into account any deductions, credits, or specific circumstances that could further affect your tax liability.

- For precise calculations, consult tax professionals or use a detailed tax calculator specifically designed for New York earnings, such as the one available through NerdWallet here or Forbes here.

This estimation provides a general overview, and it’s advisable to seek personalized advice based on your complete financial situation.

Sources

State Individual Income Tax Rates and Brackets, 2025New York State Taxes: What You'll Pay in 2025New York Income Tax: Rates, Who Pays in 2025 - NerdWalletWithholding tax rate changes - Department of Taxation and FinanceMarch 2025 changes to withholding tax and wage reportingNYC Income Tax Rate: What to Expect in 2025 - George Dimov, CPANew York Income Tax Calculator 2024-2025 - Forbes

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.