and is that before or after income tax

The weekly earning thresholds for Council Tax Reduction in Brighton & Hove are assessed based on your earned income after tax. This means that the income amounts specified to determine eligibility for discounts are calculated after any income tax deductions have been made.

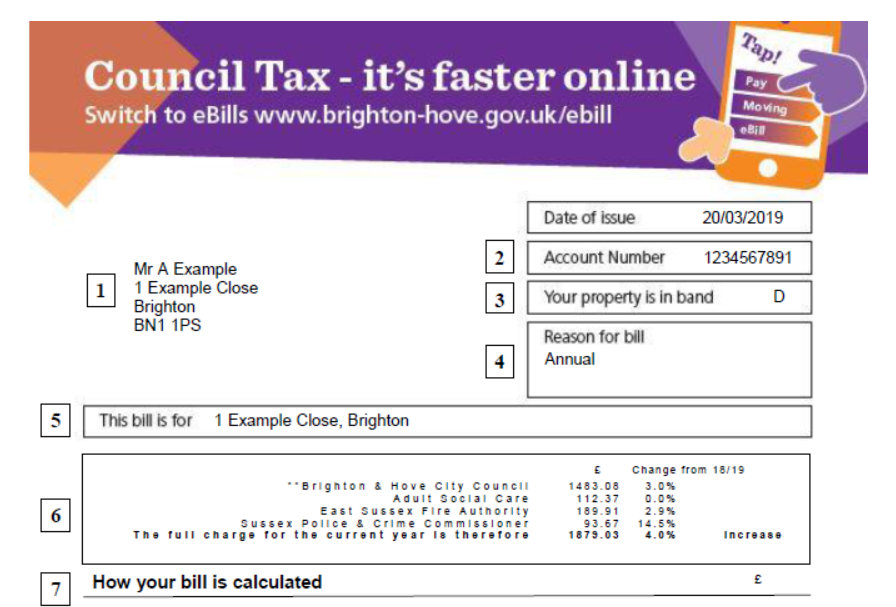

For further details regarding the calculations and criteria for these reductions, you can refer to the Brighton & Hove City Council's official page on how they calculate Council Tax Reduction here.

If you have any more questions regarding Council Tax Reduction or specific eligibility based on your financial situation, feel free to ask!

Sources

Apply for a Council Tax Reduction - Brighton & Hove City CouncilHow we calculate Council Tax Reduction[PDF] appendix 2 - Brighton & Hove City CouncilProtecting levels of Council Tax ReductionCouncil Tax - attachment of earnings ordersCheck if you can get Council Tax Reduction - Citizens AdviceCouncil tax and TV licences - University of Brighton

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.