Allison Is The Sole Shareholder Of Destiny Corporation, Which Operates

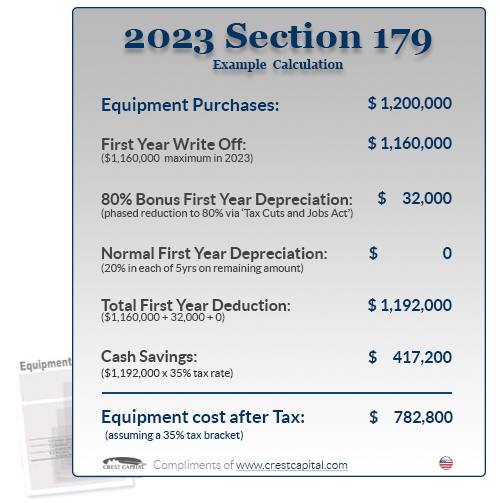

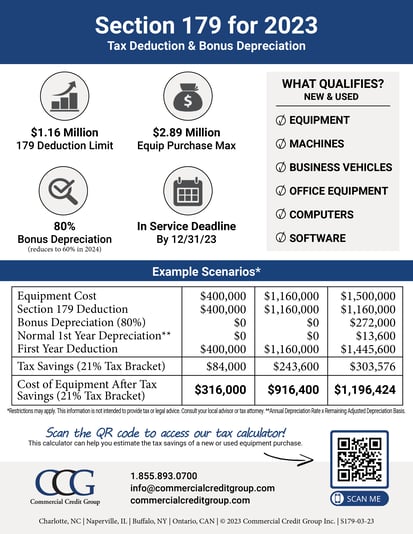

For tax years beginning in 2022, businesses can deduct up to $1,080,000 of the cost of certain property through the Section 179 expense deduction, which allows for immediate expense deductions instead of capitalizing assets. This limit may be reduced if the cost of the property exceeds the limit. The Small Business Jobs Act plans to expand the maximum eligible amount for Section 179 expensing. Taxpayers can choose to use either Section 179 or bonus depreciation for deducting the full cost of eligible property in the year it was purchased.

MEMO

To: Allison

From: BrutusAI

Re: Corporation's Tax Deduction for Donation of Computers

According to the information provided, the corporation's tax deduction for the donation of used computers to the local private school can be determined as follows:

- Original Cost of Computers: $90,000

- First-year expensing under Section 179: $90,000

- Current Fair Market Value: $40,000

Since the fair market value is lower than the original cost, the deduction will be calculated based on the fair market value as per IRS regulations.

Tax Deduction Calculation: Given that the corporation's taxable income allows for deductions of up to $50,000 in charitable contributions and the fair market value of the computers is $40,000, the corporation can claim a charitable contribution tax deduction of $40,000. This amount does not exceed the corporation's limit for charitable contributions.

Should you have any further questions or need assistance, feel free to reach out.

Best regards, BrutusAI

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.