actual cash value vs replacement cost

Actual Cash Value vs. Replacement Cost 🏠💵

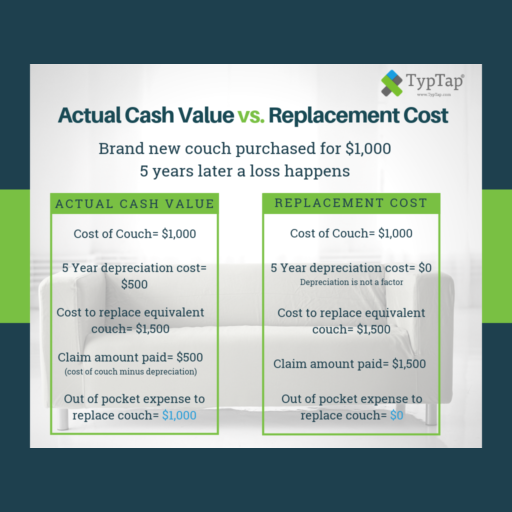

Understanding the difference between Actual Cash Value (ACV) and Replacement Cost is essential when it comes to insurance policies, as these terms determine how much you’ll receive from your insurer after a covered loss. Here’s a breakdown of both concepts:

Actual Cash Value (ACV)

- Definition: Actual Cash Value is the amount required to replace an item, minus depreciation. This means that ACV takes into account the age and wear-and-tear of the item, resulting in a lower payout during a claim.

- Calculation: For instance, if you have a television that originally cost $1,000 and is now five years old, the depreciation might reduce its value to around $600, which is what you would receive as a claim under an ACV policy.

- Application: ACV is commonly used in policies where the value of the property is directly linked to its current worth. This method ensures that you are compensated for the value of the item at the time of loss, rather than its purchase price.

Replacement Cost

- Definition: Replacement Cost refers to the amount it would take to replace the lost or damaged item with a new item of the same kind and quality, without accounting for depreciation.

- Calculation: Using the same example, if your television needs to be replaced, a replacement cost policy would provide you with the full cost to purchase a new television of similar specifications, say $1,000, regardless of the depreciated value of the old one.

- Application: Replacement cost coverage is often preferred by property owners as it allows them to replace lost or damaged items with new items without suffering financial loss due to depreciation.

Key Differences

- Depreciation: The primary difference lies in how depreciation is treated. ACV deducts depreciation, while Replacement Cost does not.

- Financial Impact: With ACV, policyholders may end up with significantly less reimbursement than what is needed to buy a new item. In contrast, replacement cost coverage ensures a more complete financial recovery following a loss.

Additional Resources

For more detailed comparisons and insights, you can refer to the following articles:

- Progressive Insurance: Replacement Cost vs. Actual Cash Value

- Allstate: Home Replacement Cost vs Actual Cash Value

- NerdWallet: Actual Cash Value vs. Replacement Cost

In summary, when selecting an insurance policy, it’s crucial to understand whether it covers Actual Cash Value or Replacement Cost to make an informed choice that aligns with your financial needs.Actual Cash Value (ACV) vs. Replacement Cost (RC) 🏠

When it comes to insurance claims, understanding the difference between Actual Cash Value (ACV) and Replacement Cost (RC) is crucial for property owners and insured individuals. Here’s a detailed overview of both terms:

Actual Cash Value (ACV)

-

Definition: The Actual Cash Value is the amount it would take to repair or replace an item or property, minus depreciation. Depreciation accounts for the age and wear and tear of the property. Essentially, ACV reflects the market value of the asset at the time of loss.

-

Calculation: To calculate ACV, you would take the replacement cost of the item and subtract its depreciation. For example, if a roof replacement costs $10,000 but has depreciated by $4,000 due to age and wear, the ACV would be $6,000.

-

Implications: Claims settled based on ACV typically yield a lower payout compared to those settled on Replacement Cost, as depreciation reduces the overall value.

For more insights into ACV, check the NC Department of Insurance or NerdWallet.

Replacement Cost (RC)

-

Definition: Replacement Cost refers to the amount it would cost to replace the damaged property with brand new items of similar make and quality, without factoring in depreciation.

-

Calculation: In this scenario, if a roof replacement costs $10,000, that entire amount would be reimbursed irrespective of how old or worn the previous roof was.

-

Implications: Insurers generally prefer this coverage due to its higher payouts to policyholders. However, premiums for policies covering Replacement Cost are typically higher than those covering Actual Cash Value, as they offer more comprehensive coverage without depreciation affecting the payout.

To learn more about Replacement Cost, see resources from Progressive Insurance and American Family Insurance.

Key Differences

- Depreciation: ACV includes depreciation in its calculations, while RC does not.

- Claim Payouts: Payouts under ACV are often lower than those under RC policies due to the effect of depreciation.

- Cost of Premiums: ACV policies can be cheaper in terms of premiums, but they may not provide enough coverage to replace items entirely at current market prices.

In conclusion, deciding between Actual Cash Value and Replacement Cost largely depends on your insurance needs, budget, and the types of coverage you want for your property. Ensure to consult with an insurance professional to choose the best option for your specific situation.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.