1099 minimum amount to report

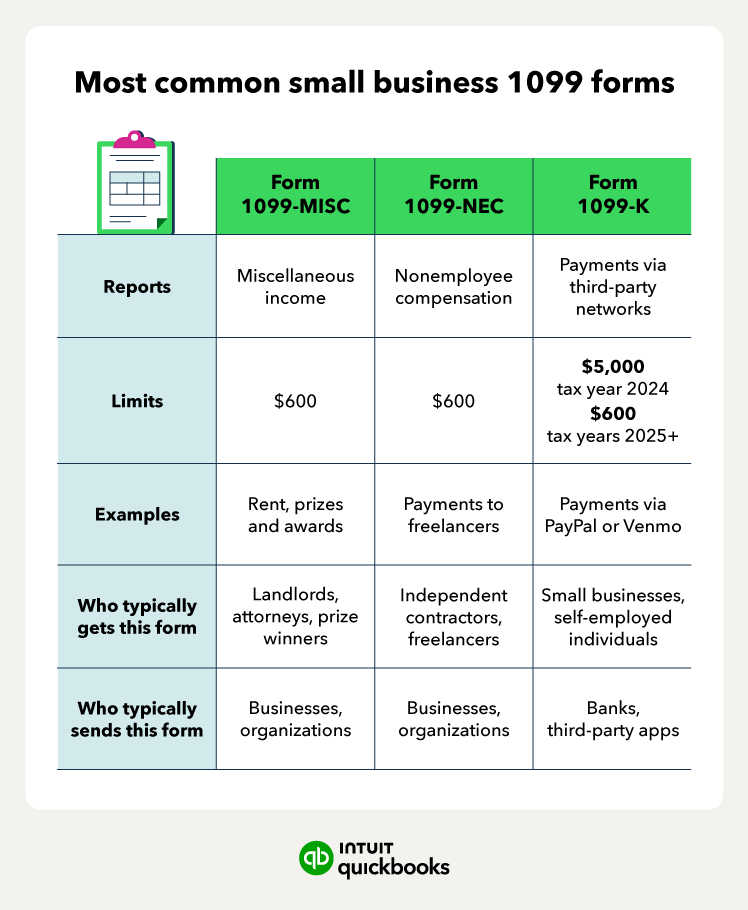

The reporting requirements for various 1099 forms, particularly the 1099-K and 1099-NEC, have specific thresholds that taxpayers should be aware of for the 2025 tax year.

-

Form 1099-K: For the 2025 tax year, the threshold for reporting via Form 1099-K has been set at $2,500. This change offers some relief to taxpayers, especially as there was an expectation that the threshold might drop to $600. The new requirement allows business payers to report payments received for goods or services without having to file for amounts under this threshold. This information is vital for those who engage in transactions that may otherwise require extensive reporting under lower thresholds. Additional details can be found on the IRS’s official page for Understanding your Form 1099-K and the article discussing the threshold set by Grant Thornton here.

-

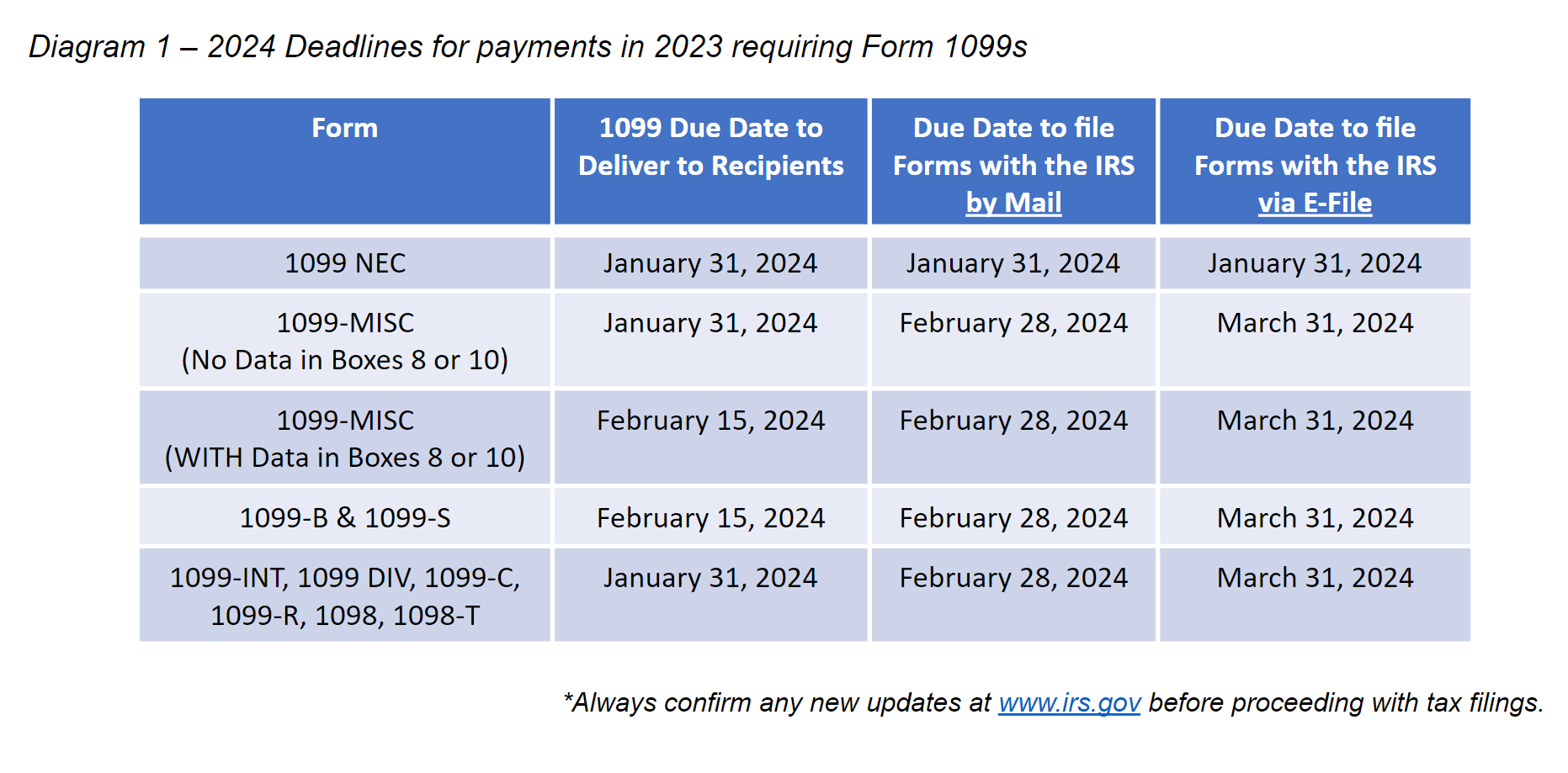

Form 1099-NEC: According to the IRS instructions for Forms 1099-MISC and 1099-NEC, if you are using Form 1099-NEC to report certain payments, the threshold remains $600 or more. This means that any business payments totaling this amount must be reported to the IRS by January 31 of the following year. More information can be found in the IRS’s comprehensive Instructions for Forms 1099-MISC and 1099-NEC.

-

General Updates on 1099 Rules: Overall, the IRS has highlighted that the upcoming changes and ongoing adjustments to reporting practices mean that individuals and businesses should stay informed. Notably, recent discussions and articles have emphasized potential shifts in thresholds, including a potential drop back to $600 unless further changes are confirmed. Further insights on the implications of these rules can be explored in resources like Tipalti’s overview of 1099 rules and TaxAct’s article on new forms.

In summary, for 2025, the minimum amount to report for Form 1099-K is $2,500, while for Form 1099-NEC, it remains at $600. Taxpayers should remain updated on changing tax regulations to ensure compliance.

Sources

Related Questions

Work fast from anywhere

Stay up to date and move work forward with BrutusAI on macOS/iOS/web & android. Download the app today.